Welcome to your comprehensive October 2024 update on the Knoxville and East Tennessee housing markets! Whether you’re buying, selling, or just curious about the local real estate scene, we’ve got the latest insights and data you need.

Market Overview: East Tennessee

In October 2024, home sales in East Tennessee experienced a slight decline, down by 2.7% compared to last year. However, the inventory of homes surged by 37.9%, with new listings up by 7.1%. This increase in inventory provides more options for buyers, even as the market adjusts to rising interest rates and pre-election jitters.

Key Metrics:

- Median Sales Price: $374,900 (up 7.11%)

- Average Price per Square Foot: $225

- Absorption Rate: 3.94 months (indicating more inventory and potentially less demand)

Despite fluctuations, East Tennessee’s housing prices remain stable to slightly rising, especially in high-demand areas.

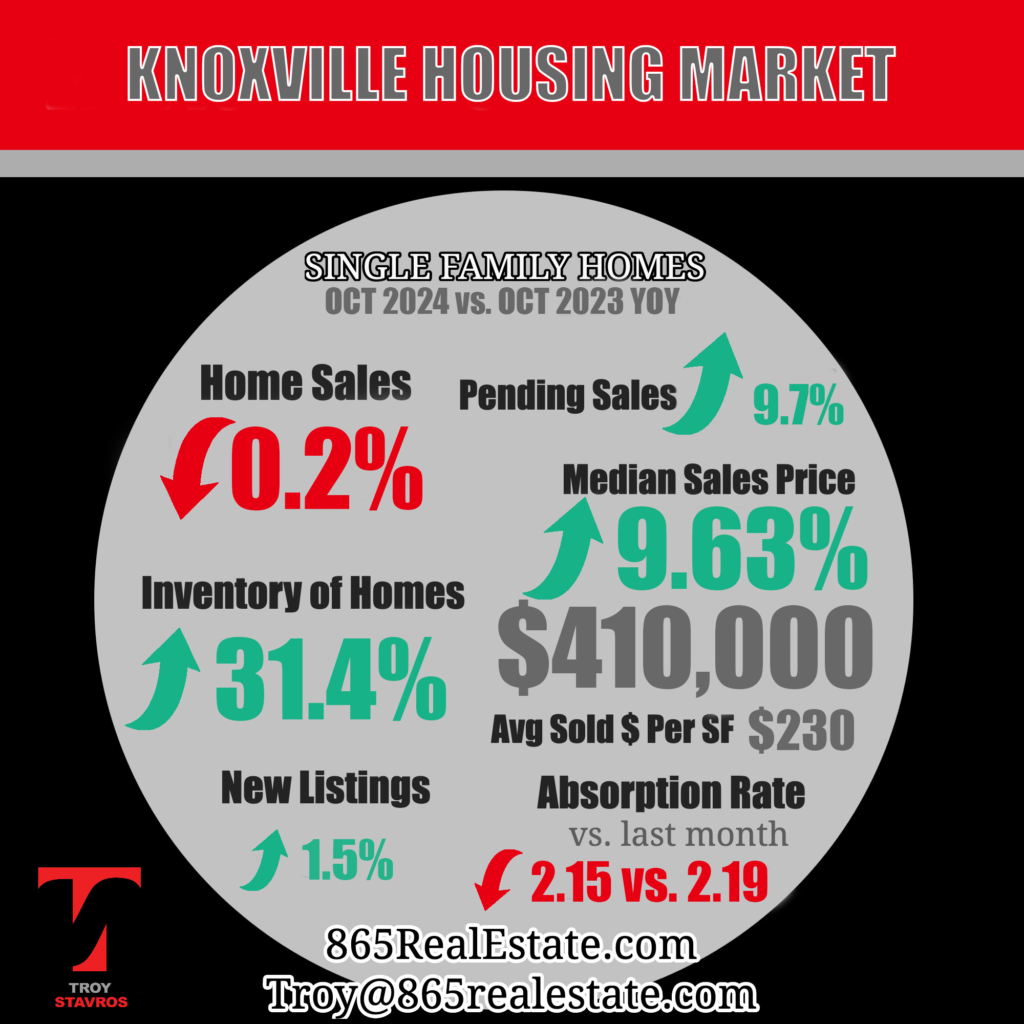

Knoxville Real Estate Insights

Knoxville’s housing market shows resilience with home sales nearly steady, down just 0.2% from last year. The inventory increased by 31.4%, with new listings up by 1.5%. The city continues to see strong buyer interest, as reflected in the decrease in the absorption rate to 2.15 months.

Key Metrics:

- Median Sales Price: $410,000 (up 9.63%)

- Average Price per Square Foot: $230

Knoxville’s limited inventory suggests a continuing trend of rising home prices, driven by strong demand and insufficient supply.

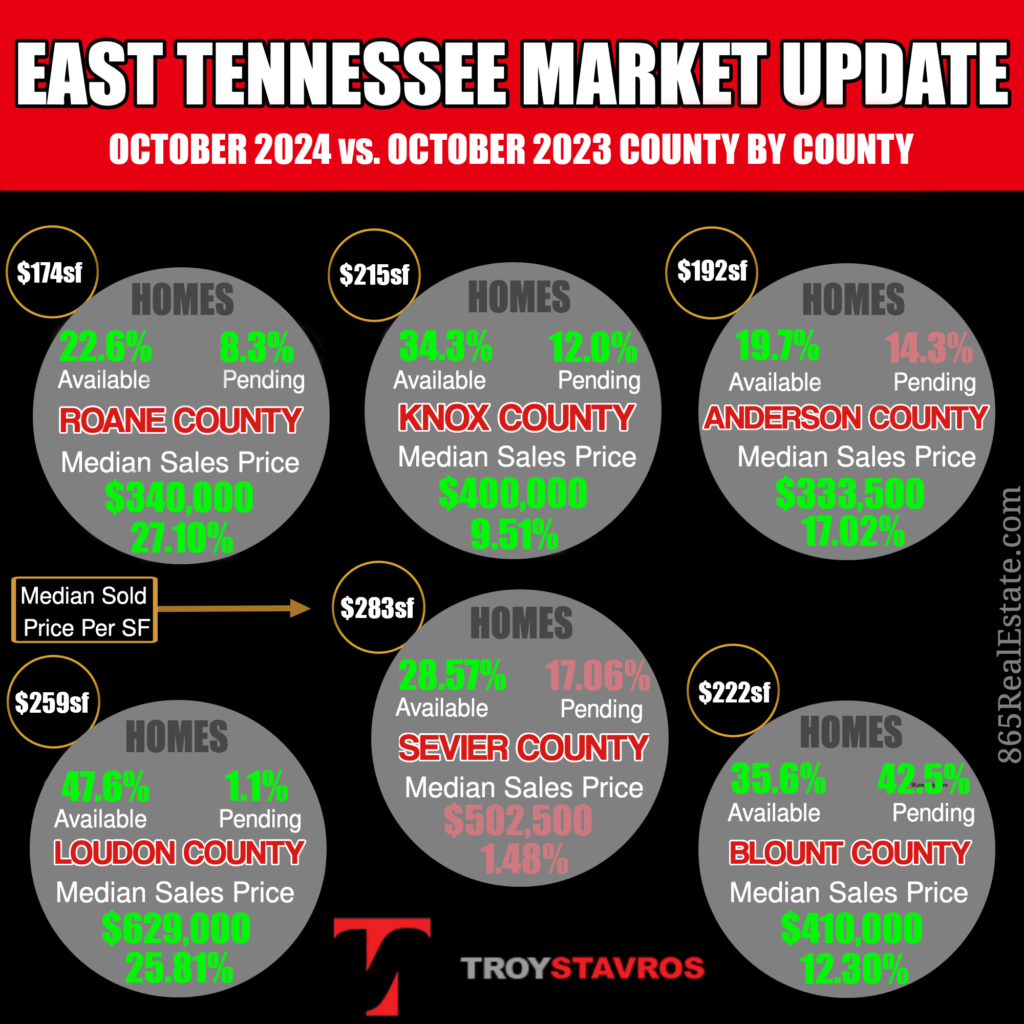

County Breakdown

Roane County

- Inventory Up: 22.6%

- Median Sales Price: $340,000 (up 27.10%)

Knox County

- Inventory Up: 34.3%

- Median Sales Price: $400,000 (up 9.51%)

Anderson County

- Inventory Up: 19.7%

- Median Sales Price: $333,500 (up 17.02%)

Loudon County

- Inventory Up: 47.6%

- Median Sales Price: $629,000 (up 25.81%)

Sevier County

- Inventory Up: 28.57%

- Median Sales Price: $502,500 (down 1.48%)

Blount County

- Inventory Up: 35.6%

- Median Sales Price: $410,000 (up 12.3%)

Market Trends and Predictions

As we head into the end of the year, several factors will influence the Knoxville and East Tennessee housing markets:

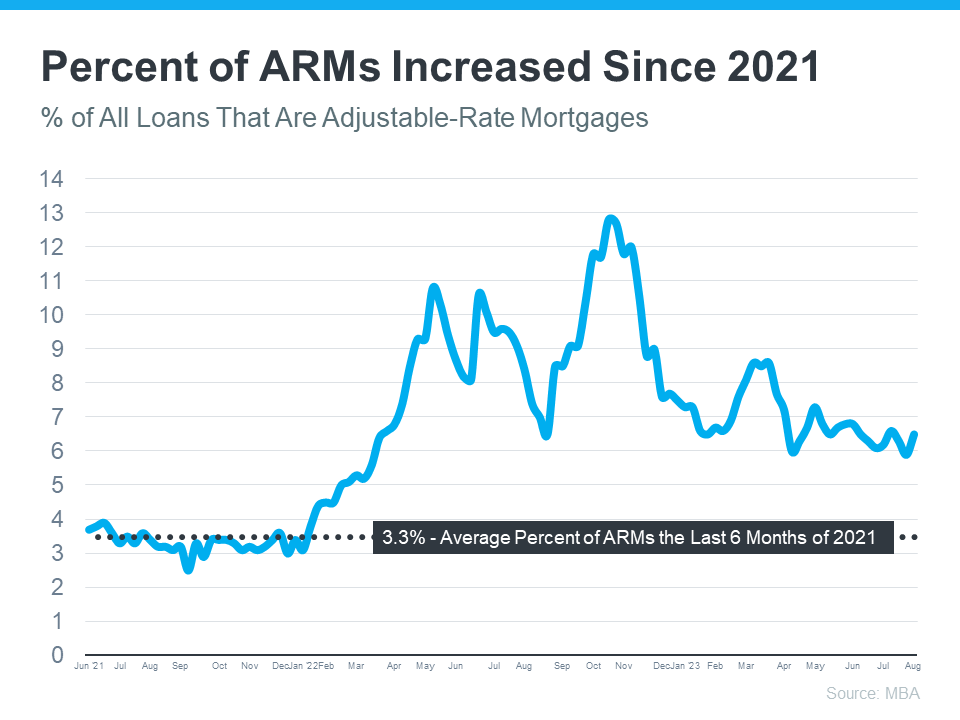

- Interest Rates: Rising rates continue to impact affordability and buyer behavior.

- Inventory Levels: While inventory is up, it remains below pre-pandemic levels, keeping pressure on prices.

- Migration Patterns: Tennessee’s appeal due to its cost of living and quality of life continues to attract new residents, bolstering demand.

Conclusion

The Knoxville and East Tennessee real estate markets are navigating a complex landscape of increased inventory, rising prices, and changing buyer dynamics. For potential buyers and sellers, understanding these trends is crucial for making informed decisions.

If you’re considering buying or selling a home in Knoxville or East Tennessee, contact us at Cornerstone Realty Associates for expert guidance tailored to your needs.

Stay tuned for more updates as we continue to monitor the local real estate market. For personalized advice, reach out to Troy Stavros and the team at Cornerstone Realty Associates.