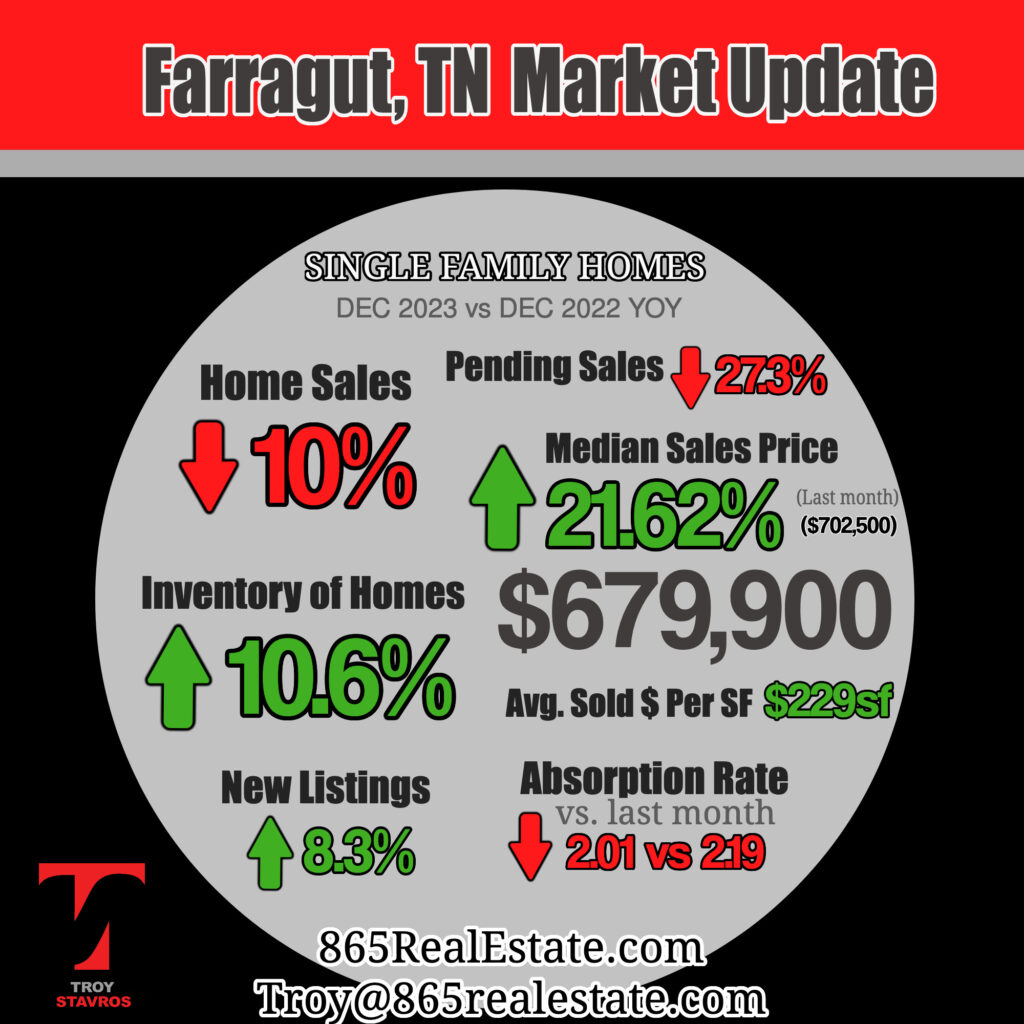

A Year in Review: Insights into Farragut's Real Estate Dynamics As 2023 draws to a close, the Farragut, Tennessee, real estate market presents a unique landscape for buyers, sellers, and homeowners. This video provides a synthesized overview of market trends, offering valuable insights as we head into 2024. Current Market Trends in Farragut Farragut's housing market in December 2023 shows some distinct trends: Price Adjustments: There's been a notable trend in home prices throughout the year, either trending upwards or showing signs of stabilization. Inventory Fluctuations: The availability of homes in Farragut has either increased, suggesting a buyer's market, or decreased, indicating a seller's market. Sales Velocity: The time homes spend on the market in Farragut might have changed, affecting how quickly sellers can expect to close a deal. Implications for Market Participants For Prospective Buyers: This information is crucial for those looking to purchase a home in Farragut. It can guide you in making timely decisions and negotiating the best deals. For Sellers: Sellers can use these insights to strategize their sales approach, from pricing to marketing their property. For Current Homeowners: Stay informed about your property’s value and the overall health of the Farragut real estate market. Forecast for 2024 Looking ahead, the Farragut housing market is expected to continue evolving. Potential buyers and sellers should stay informed about market conditions to make the most of their real estate investments. Conclusion Farragut's real estate market remains dynamic and attractive for various real estate activities. Whether you're buying, selling, or just keeping an eye on the market, staying up-to-date with the latest trends is crucial. For more personalized advice or detailed market insights in Farragut, contact Troy Stavros with CornerStone Realty Associates at 865-999-0925 today.