Much has been written about how residential real estate values have increased since the housing market started its recovery in 2012. However, little has been shared about what has taken place with residential rental prices. Let’s shed a little light on this subject.

In the most recent Apartment Rent Report, RentCafe explains how rents have continued to increase over the last twelve months because of a large demand and a limited supply.

“Continued interest in rental apartments and slowing construction keeps the national average rent on a strong upward trend.”

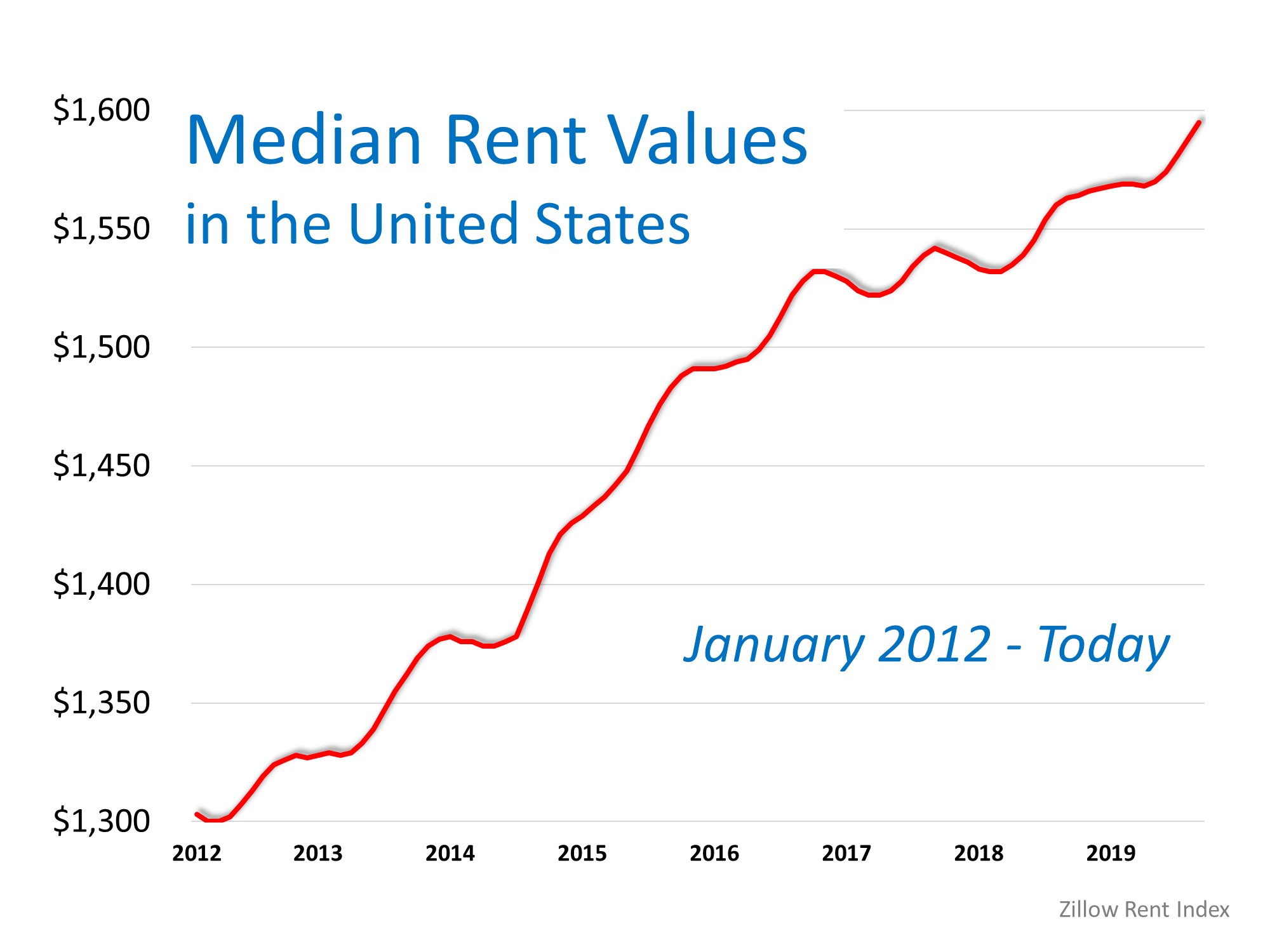

Zillow, in its latest Rent Index, agreed that rents are continuing on an “upward trend” across most of the country, and that the trend is accelerating:

“The median U.S. rent grew 2% year-over-year, to $1,595 per month. National rent growth is faster than a year ago, and while 46 of the 50 largest markets are showing deceleration in annual home value growth, annual rent growth is accelerating in 41 of the largest 50 markets.”

The Zillow report went on to detail rent increases since the beginning of the housing market recovery in 2012. Here is a graph showing the increases:

Bottom Line

It is true that home prices have risen over the past seven years, increasing the cost of owning a home. However, the cost of renting a home has also increased over that same time period.

Are you ready to get off the rental train and start paying down your own mortgage instead of your landlord’s? Call/text me, Troy Stavros with CornerStone Realty Associates at 865-205-6899. Worried about not having enough for a down payment or closing costs? I know of programs that can help there too!

![A+ Reasons to Hire a Real Estate Pro [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/09/03132635/20190906-MEM-1046x1308.jpg)

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/07/19100001/20190719-MEM-1046x784.jpg)

![10 Steps to Buying a Home This Summer [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/06/09105728/20190628-10-Steps-MEM-1046x808.jpg)