How about a Historic 100+ year old home on the square in Historic Downtown Loudon? Along the banks of the Tennessee River, you can take a step back in time and enjoy all the comforts of small-town living and then some. This charming multi-use facility was built in 1900 and has been remodeled/restored and is in outstanding condition. Located on the busy and revitalized Downtown Loudon Square, it sits directly across from the Loudon County Courthouse. Within a 5 minute stroll, you can enjoy multiple restaurants, shops, professional services, an ice cream parlor and more. Currently zoned commercial and on the docket for a possible zoning change to residential, this property could serve multiple uses. Office, coffee shop, antique shop, possible short-term rental, long-term rental, private residence, or shop/office with private residence above. Lots of possibilities. Public street parking in front and a private parking lot in the back. Don’t miss this amazing opportunity on a one-of-a-kind property.

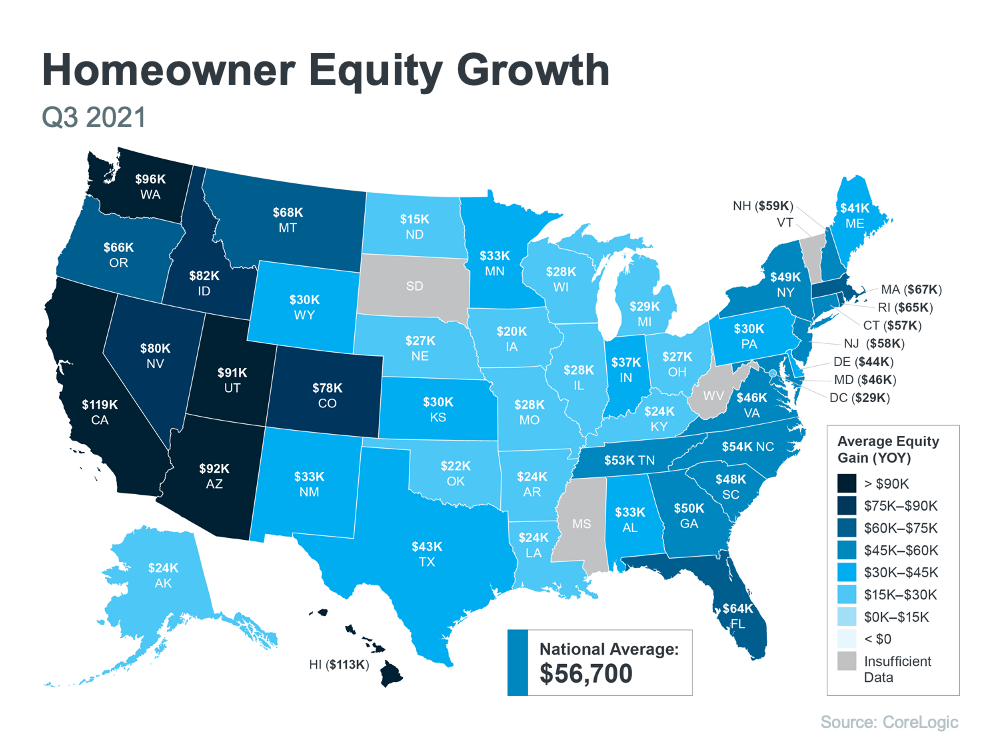

The Average Homeowner in Tennessee Gained $53,000 in Equity over the Past Year

When you think of homeownership, what’s the first thing that comes to mind? Chances are you might focus on the non-financial benefits, like the security or stability that a home provides. But what about equity? While it can be overlooked, a homeowner’s equity helps build long-term wealth over time. Here’s a look at what equity is and why it matters.

For a homeowner, your equity is the current value of your home minus what you owe on the loan. So, as home values climb, your home equity does too. That’s exactly what’s happening today. There aren’t enough homes on the market to meet buyer demand, so bidding wars and multiple offers are driving prices up. That’s because people are willing to pay more to buy a home. Right now, this low supply and high demand are giving current homeowners a significant equity boost.

Dr. Frank Nothaft, Chief Economist at CoreLogic, explains it like this:

“Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home prices were up 17.7% for the past 12 months ending September, spurring the record gains in home equity wealth.”

To find out just how much rising home values have impacted equity, we turn to the latest Homeowner Equity Insights from CoreLogic. According to that report, the average homeowner’s equity has grown by $56,700 over the last 12 months.

Curious how your Tennessee stacks up? Check out the map above and you’ll see our average is $53,000 in equity gained.

How Rising Equity Impacts You

If you’re already a homeowner in East Tennessee, equity not only builds your wealth, it also opens doors for you to achieve your goals. It works like this: when you sell your house, the equity you built up comes back to you in the sale. You can use those proceeds to fuel your next move, especially if you’ve decided your needs have changed and you’re looking for something new.

If you’re thinking about becoming a homeowner in East Tennessee, understanding the importance of equity can help you realize why homeownership is a worthwhile goal. It builds your wealth and gives you peace of mind that your investment is a wise one, not just from a lifestyle perspective, but from a financial one too.

Bottom Line

Whether you’re a current homeowner in East Tennessee or you’re ready to become one, it’s important to know how equity works and why it matters. If this inspires you to make a move, let’s connect to explore your options and find out what steps you need to take next.

Contact the Troy Stavros TEAM at CornerStone Realty Associates today at 865-999-0925.

East Tennessee Homebuyers: Be Ready To Act This Winter

To succeed as a buyer in today’s East Tennessee market, it’s important to understand which market trends will have the greatest impact on your home search. Danielle Hale, Chief Economist at realtor.com, says there are two factors every buyer should keep their eyes on:

“Going forward, the conditions buyers face are primarily dependent on two things: mortgage rates and housing supply.”

Here’s a look at each one.

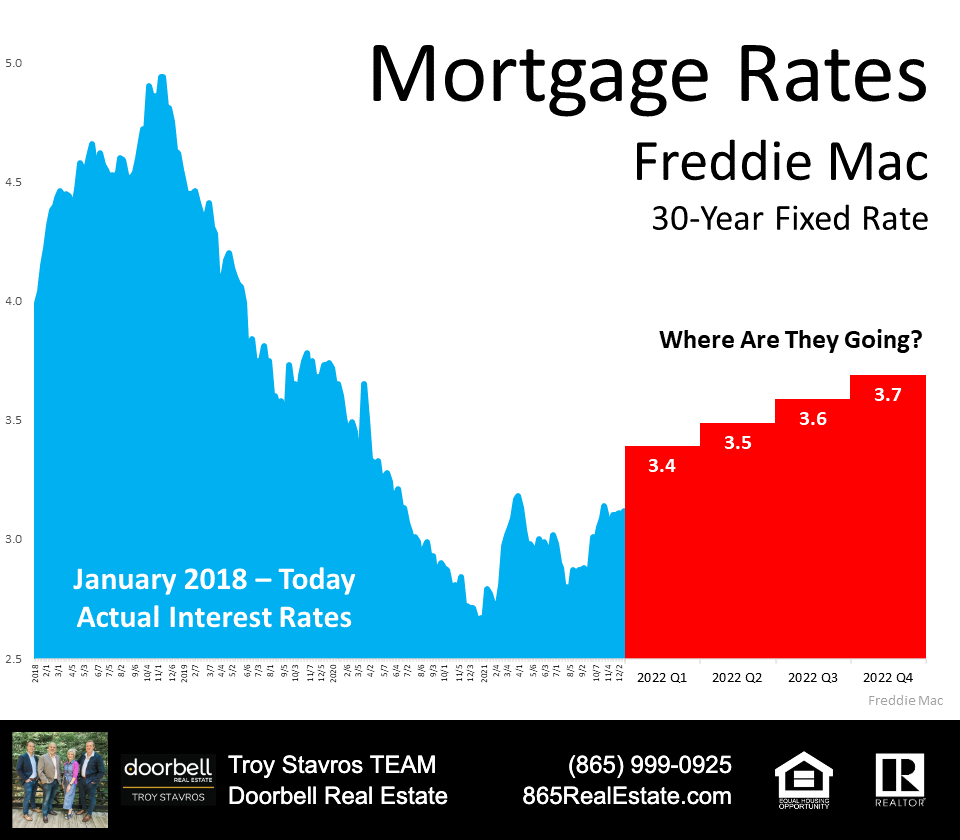

Mortgage Rates Projected To Rise in 2022

As a buyer, your interest rate directly impacts how much you’ll pay on your monthly mortgage when you purchase a home in East Tennessee. Rates are beginning to rise, and experts forecast they’ll continue going up in 2022 (see graph below): As the graph shows, mortgage rates are expected to climb next year. But they’re still low when you compare to where they were just a few years ago. That presents today’s buyers with some motivation to lock in a low mortgage rate before they climb higher.

More Homes Are Expected To Be Available This Season in East Tennessee

The other market condition buyers need to monitor is the number of homes available for sale today in East Tennessee. The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the current supply of inventory sits at just 2.4 months. To put that into perspective, a 6-month supply is ideal for a balanced market where there are enough homes to meet buyer demand.

However, there may be good news for buyers in East Tennessee who are waiting for more options. A recent realtor.com survey shows more sellers are planning to list their homes this winter, meaning more choices will likely be available soon.

What Does That Mean for You?

Even if your options improve some this season, it won’t significantly shift market conditions overnight. According to NAR, MANY more listings need to be available to move closer to a more neutral market:

“Given the average monthly demand . . . , 3.55 million homes should be on the market to meet a level of inventory equal to six months of demand, implying a shortage of homes for sale of 2.24 million.”

So remember, even with more homes expected to come to market this season, competition among buyers in East Tennessee will remain fierce as there still won’t be enough homes for sale to meet the current demand. That means you’ll need to act quickly when you’re ready to make an offer.

Bottom Line

If you’re planning on buying a home in East Tennessee this winter, more options are welcome news, but it doesn’t mean you should slow down. Let’s connect today so you have an expert on your side to help act as quickly as possible when the right home for you hits the market.

Contact us, the Troy Stavros TEAM at CornerStone Realty Associates at 865-999-0925 to get the process started today.

Knoxville, Tennessee ranks in the Top 10 Housing Market “Hidden Gems” in 2022

The National Association of REALTORS identified 10 housing markets as “hidden gems” that are expected to experience stronger price appreciation relative to other markets in 2022. In alphabetical order, the markets are as follows:

| – Dallas-Fort Worth, Texas – Daphne-Fairhope-Farley, Alabama – Fayetteville-Springdale-Rogers, Arkansas-Missouri – Huntsville, Alabama – Knoxville, Tennessee – Palm Bay-Melbourne-Titusville, Florida – Pensacola-Ferry Pass-Brent, Florida – San Antonio-New Braunfels, Texas – Spartanburg, South Carolina – Tucson, Arizona “The housing sector performed spectacularly in 2021 in many markets, with huge gains achieved in places like Austin, Boise and Naples,” Yun said. “Several markets did reasonably well in 2021, but not as strong as the underlying fundamentals suggested. Therefore, in 2022, these ‘hidden gem’ markets have more room for growth.” NAR considered a market a hidden gem based on two categories: 1) If the market’s ratio of median home price to median family income is in the lower half of the 379 metro areas analyzed. 2) If the following seven indicators reflecting the strength of housing demand for that market are in the upper half of metro areas: 1. Wage growth 2. Job growth 3. Ratio of the change in population to the sum of housing permits 4. Population growth 5. Net domestic migration 6. Percentage of the population ages 25 to 44 7. Percentage of households with broadband service NAR’s top 10 list only includes metro areas with populations of at least 200,000. |

Advice for First-Generation Homebuyers in East Tennessee

The sense of pride you’ll feel when you purchase a home in East Tennessee can’t be overstated. For first-generation homebuyers, that feeling of accomplishment is even greater. That’s because the pride of homeownership for first-generation buyers extends far beyond the homebuyer. AJ Barkley, Head of Neighborhood and Community Lending for Bank of America, says:

“Achieving this goal can create a sense of pride and accomplishment that resonates both for the buyer and those closest to them, including their parents and future generations.”

In other words, your dream of homeownership has far-reaching impacts. If you’re about to be the first person in your family to buy a home, let that motivate you throughout the process. As you begin your journey, here are three helpful tips to make that dream come true.

1. Reach Out to a Real Estate Professional

It’s important to reach out to a trusted East Tennessee real estate advisor early in your homebuying process. Not only can an agent help you find the right home, but they’ll serve as your expert advisor and answer any questions you might have along the way.

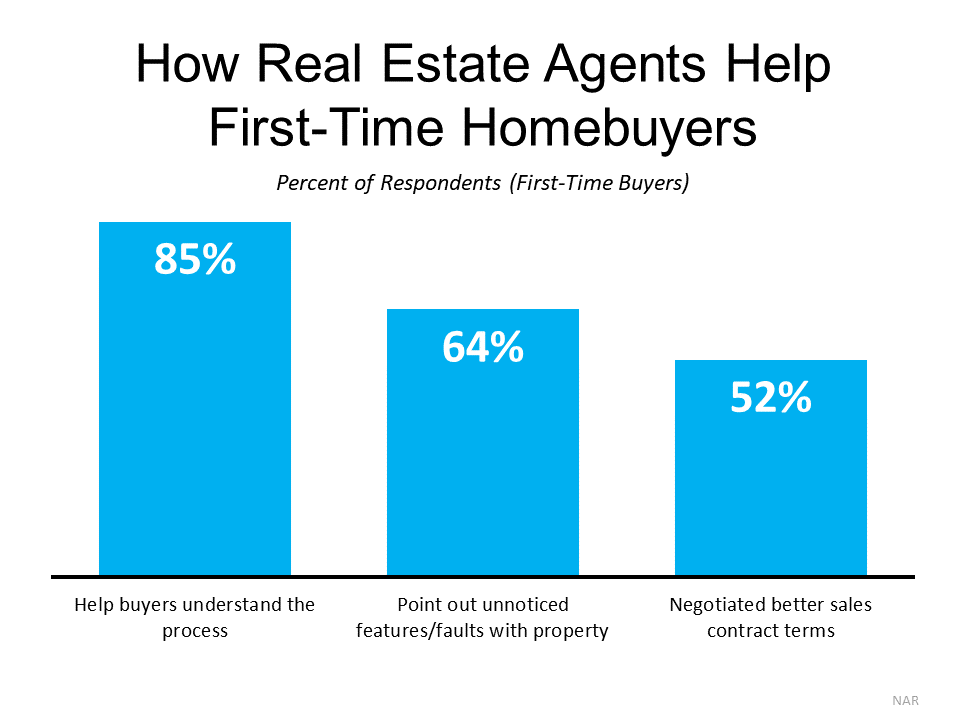

The latest Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) surveyed first-time homebuyers to see how their agent helped them with their home purchase (see chart below):

As the graph shows, your real estate agent is a great source of information throughout the process. They’ll help you understand what’s happening, assess a home’s condition, and negotiate a contract that has the best possible terms for you. These are just some of the reasons having an expert in your corner is critical as you navigate one of the most significant purchases of your life.

2. Do Your Research and Know What You Can Afford

The second piece of advice for first-generation homebuyers in East Tennessee is practical: do your research so you know what you can afford. That means getting your finances in order, reviewing your budget, and getting pre-approved through a lender. It also means learning the ins and outs of what it takes to pay for your home, including what you’ll need for a down payment.

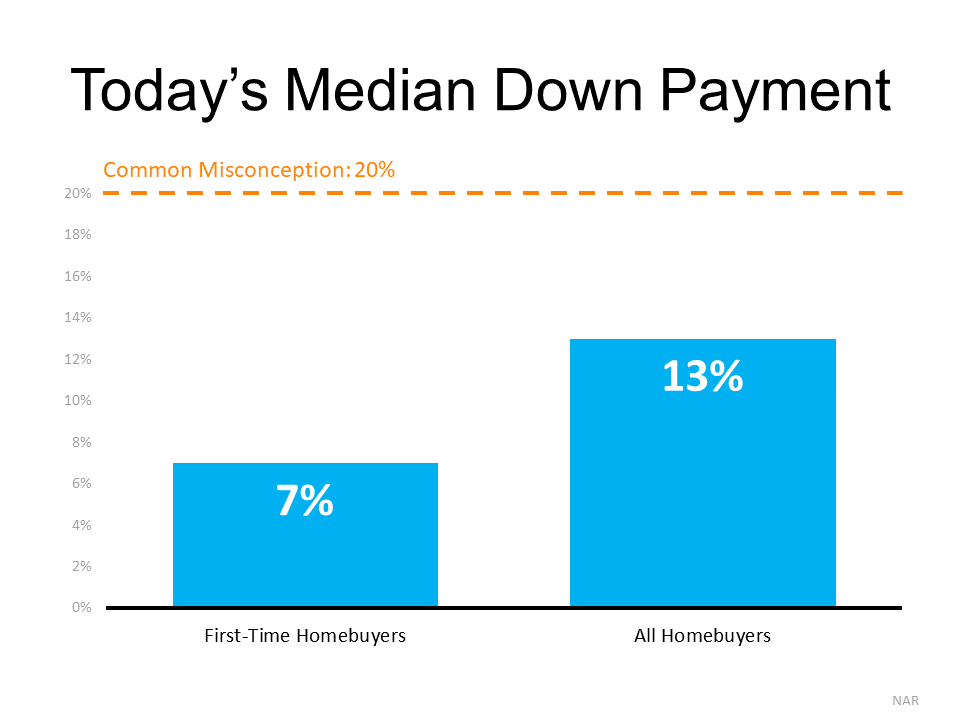

Many homebuyers believe the common misconception that you can’t purchase a home in East Tennessee without coming up with a 20% for a down payment. As Freddie Mac says:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

The chart below shows what recent homebuyers have actually put down on their purchases:

On average, first-time home buyers only put 7% down on their home purchase. That’s far less than the 20% many people believe is necessary. That means your down payment, and your home purchase, may be in closer reach than you realize. Keep that in mind as you work with an East Tennessee real estate professional to better understand what you’ll need for your purchase.

3. Don’t Lose Sight of What Home Means to You

Finally, it’s important keep in mind why you’re searching for a home to begin with. Overwhelmingly, first-generation homeowners recognize the financial and non-financial benefits of owning a home. In fact, in a recent survey:

- 73% of first-generation homeowners say the safety and security homeownership provides is increasing in importance.

- Nearly two-thirds of first-generation homeowners say the importance of building equity in a home is growing more important as well.

As AJ Barkley explains:

“For many first-generation homeowners and their families, homeownership has a unique importance, given the collective efforts to overcome financial challenges that can often span generations…”

Bottom Line

If you’re a first-generation homebuyer in East Tennessee, being prepared and working with a trusted expert is key to achieving your dream. Let’s connect today so you can get started on your path to homeownership.

Contact the Troy Stavros TEAM at CornerStone Realty Associates today at 865-999-0925 today and let’s talk about getting the process started!

Will Home Prices Drop in East Tennessee in 2022?

If you’re thinking of buying a home in East Tennessee in today’s housing market, you may be wondering how strong your investment will be. You might be asking yourself: if I buy a home now, will it lose value? Or will it continue to appreciate going forward? The good news is, according to the experts, home prices are not projected to decline. Here’s why.

With buyers in East Tennessee still outweighing sellers, home prices are forecast to continue climbing in 2022, just at a slower or more moderate pace. Why the continued increase? It’s the simple law of supply and demand. When there are fewer items on the market than there are buyers, the competition for that item makes prices naturally rise. Want another example of this right now… used cars!

And while the number of homes for sale in East Tennessee is expected to improve with more sellers getting ready to list their houses this winter and spring, we’re certainly not out of the inventory woods yet. Thus, the projections show continued appreciation, but at a more moderate rate than what we’ve seen over the past year.

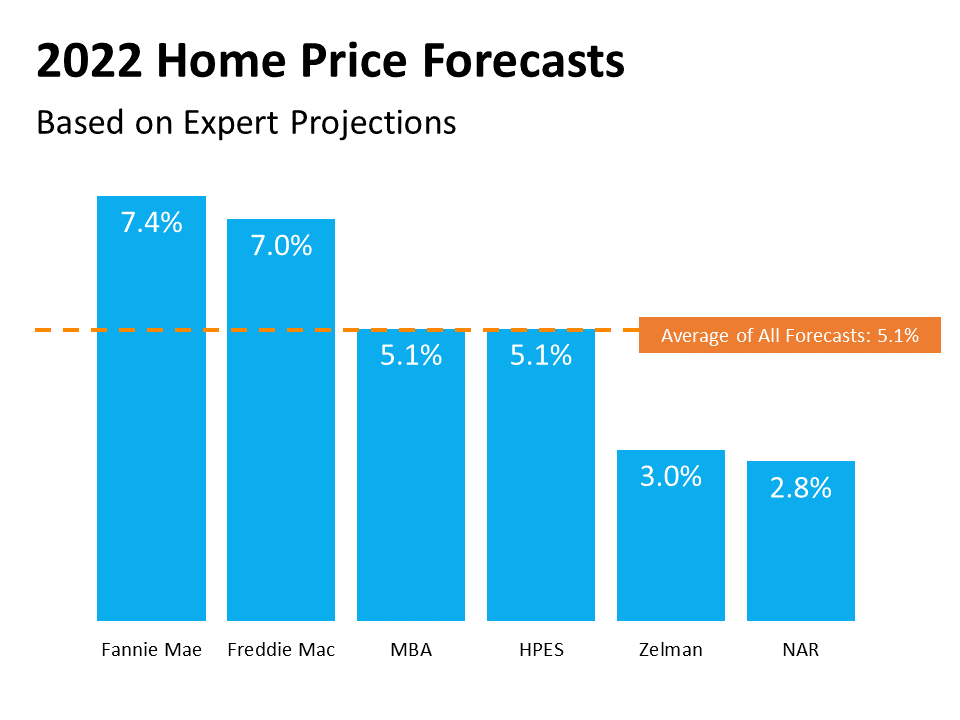

Here’s a look at the latest 2022 expert forecasts on home price appreciation: What’s the biggest takeaway from this graph? NONE of the major experts are projecting depreciation in 2022. They’re all showing an increase in home prices next year.

And here’s what some of the industry’s experts say about how that will play out in the housing market next year:

Brad Hunter of Hunter Housing Economics explains:

“. . . the recent unsustainable rate of home price appreciation will slow sharply. . . . home prices will not decline. . . but they will simply rise at a more sustainable pace.”

Danielle Hale from realtor.com agrees:

“Price growth is expected to move back toward a normal range, but this is on top of recent high prices, . . . So prices will [still] hit new highs. . . . The pace of price growth is going to slow notably . . . ”

What Does This Mean for the East Tennessee Housing Market?

While home price appreciation in East Tennesee is expected to continue, it isn’t projected to be the record-breaking 18 to almost 20% increase the market saw over the past 12 months. Overall, it’s important to note that price increases won’t be as monumental as they were in 2021 – but they certainly won’t decline anytime soon.

What Does That Mean for You?

With motivated buyers in the East Tennessee market and so few homes available to purchase, the imbalance of supply and demand will continue to put upward pressure on home prices in 2022. And when home price appreciation is in the forecast, that’s a clear indication your investment in homeownership is a sound one.

Bottom Line

It’s important to know that home prices in East Tennessee are not projected to decline in the new year. Instead, they’re forecast to rise, just at more moderate pace. Let’s connect to make sure you’re up to date on what’s happening with home price appreciation in East Tennessee, so you can make an informed decision about your next move.

Have questions or want to get the process started? Contact (call or text) the Troy Stavros TEAM at CornerStone Realty Associates at 865-999-0925 today. We look forward to serving you in all of your East Tennessee real estate needs.

- « Previous Page

- 1

- …

- 13

- 14

- 15

- 16

- 17

- …

- 109

- Next Page »