*IMPORTANT INFO ON 3 CURRENT SCAMS HAPPENING NATIONWIDE* I sat down with Linda Reitz-Hamm of Superior Title & Escrow to talk about 3 scams out there that homeowners, home sellers, and home buyers MUST be aware of. People are losing MASSIVE amounts of money (totaling in the BILLIONS), so you’ll want to educate yourself on these so you can see them coming, as they can look very legit. Have questions about this or anything else real estate related? Contact Troy Stavros with CornerStone Realty Associates at 888-388-DOOR xt.707.

2 Tips For Selling Your Home Fast and For Top Dollar

Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive the maximum value for your house?

Here are two keys to ensure that you get the highest price possible.

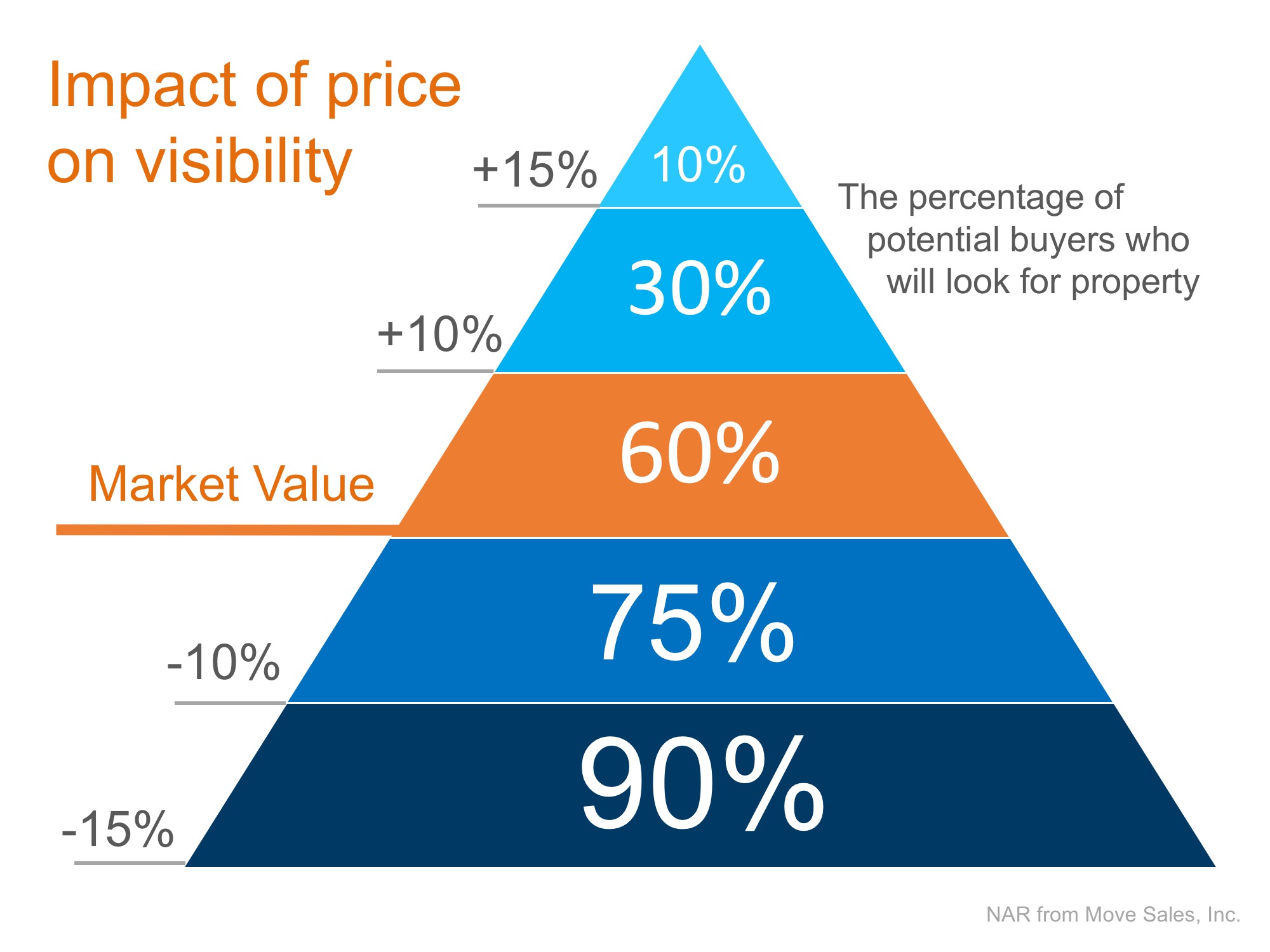

1. Price it a LITTLE LOW

This may seem counterintuitive, but let’s look at this concept for a moment. Many homeowners think that pricing their homes a little OVER market value will leave them with room for negotiation. In actuality, this just dramatically lessens the demand for your house (see chart below).

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. By doing this, the seller will not be fighting with a buyer over the price but will instead have multiple buyers fighting with each other over the house.

HGTV gives this advice:

“First impressions are everything when selling your home. Studies have shown that the first two weeks on the market are the most crucial to your success. During these initial days, your home will be exposed to all active buyers.

If your price is perceived as too high, you will quickly lose this initial audience and find yourself relying only on the trickle of new buyers entering the market each day. Markets are dynamic, and your price has an expiration date. You have one chance to grab attention. Make sure your pricing helps you stand out on the shelf — in a positive way.”

2. Use a Real Estate Professional

This, too, may seem counterintuitive. The seller may believe that he or she will make more money without having to pay a real estate commission, but studies have shown that homes typically sell for more money when handled by a real estate professional.

Research by the National Association of Realtors in their 2018 Profile of Home Buyers and Sellers revealed that,

“the median selling price for all FSBO homes was $200,000 last year. However, homes that were sold with the assistance of an agent had a median selling price of $264,900 – nearly $65,000 more for the typical home sale.”

Bottom Line

Price your house at or slightly below the current market value and hire a professional. This will guarantee that you maximize the money you get for your house.

Top 4 Home Improvement Projects That Net The Most Return On Investment

Some Highlights:

- If you are planning on listing your house for sale this year, here are the top four home improvement projects that will net you the most Return on Investment (ROI).

- Minor bathroom renovations can go a long way toward improving the quality of your everyday life and/or impressing potential buyers.

- Upgrading your landscaping or curb appeal helps get buyers in the door. These upgrades rank as the 2nd and 4th best renovations for returns on investment.

House Hunting in Knoxville: What Should Seniors Know?

Choosing Knoxville for your retirement plan is a wise choice. One study, evaluating key elements like cost of living, quality of life and employability, determined that Knoxville is the number one destination for people looking to retire early.

There are many considerations seniors need to take into account when buying a home – health, budget, the ability to access care, downsizing and ability to access needed services. With these factors to keep in mind, a Knoxville Real Estate Professional has the experience needed to help you through the entire process without missing a beat.

Here are a few things you should know and discuss with your real estate agent:

Your future budget matters as much as your present budget.

In Knoxville, the median home sold price is just over $201k, which is below the national average. Even though the city may be cost-effective, affording a house requires more than just scraping together money for a down payment. You will have to review your financial situation as a whole to determine if you will be able to manage the cost of buying and owning a new home.

One budgetary concern that many seniors face is old debt. As your age and moved to a fixed income situation, you may find that managing debt payments becomes more difficult. Additionally, as health needs grow, many seniors may be shocked by the cost of care. Some steps you can take to get a sense of your finances sooner rather than later include:

-

Evaluating your eligibility for Medicare or Medicaid for your health expenses

-

Checking in on your 401k or other retirement plans to calculate your expected monthly income after you’ve stopped working

Location, location, location.

You have already settled on Knoxville for your preferred destination, but keep in mind that even within Knoxville some locations may be better than others when it comes to your lifestyle. For example, when choosing a home, it is important to keep in mind how close you are to a hospital in case you experience a medical emergency.

Luckily, Knoxville as a city has different programs and services aimed to improve the quality of life for older people, including programs that help them remain in their own homes for as long as possible. They offer a broad spectrum of health and nutrition-related services, consumer and home-safety related services, in-home services, and educational, recreational, and even volunteer opportunities for seniors.

Beyond your high-level needs, you will want to know how close your new home is to everyday conveniences. Where is the nearest library? How far away is the grocery store? Are there any parks you can walk to just to get some air? These may seem like simple questions, but having these things nearby can definitely improve the quality of life.

Accessibility and health should be major factors in a home.

You need to keep your mobility limitations or future mobility limits in mind when buying a home.

The number one mobility issue affecting seniors is falling, which can cause serious and sometimes permanent injury. It may be wise to search for a ranch-style home instead of a multi-story home to avoid accidents. Other home amenities to look for that can help keep you safe include:

-

A shower and toilet with space for grab bars or another support device in case you need to install them now or in the future

-

If you choose a multi-story home, at least one bathroom on the main level – ideally with a full bath

-

Wide hallways and doorways to make sure you can navigate your home in a wheelchair if needed

-

Outlets and switches that can be reached from a wheelchair – around 2 to 4 feet from the ground

-

At least one entry to the home that doesn’t involve steps

If you have health, mobility or accessibility issues, you have many different housing options in the Knoxville area. There are 29 assisted living facilities in Knoxville and 10 others in the nearby area. These facilities are ideal for seniors who want to maintain their independence, but may need assistance with activities of daily living.

Bottom Line:

As a senior, knowing your options, as well as the circumstances that make buying a home in older age unique, will put you in a good position to make the right choice. Your dream home may already be within your reach. Have questions or want to get the process started? Contact me, Troy Stavros with CornerStone Realty Associates at 865-999-0925 to setup a time to talk.

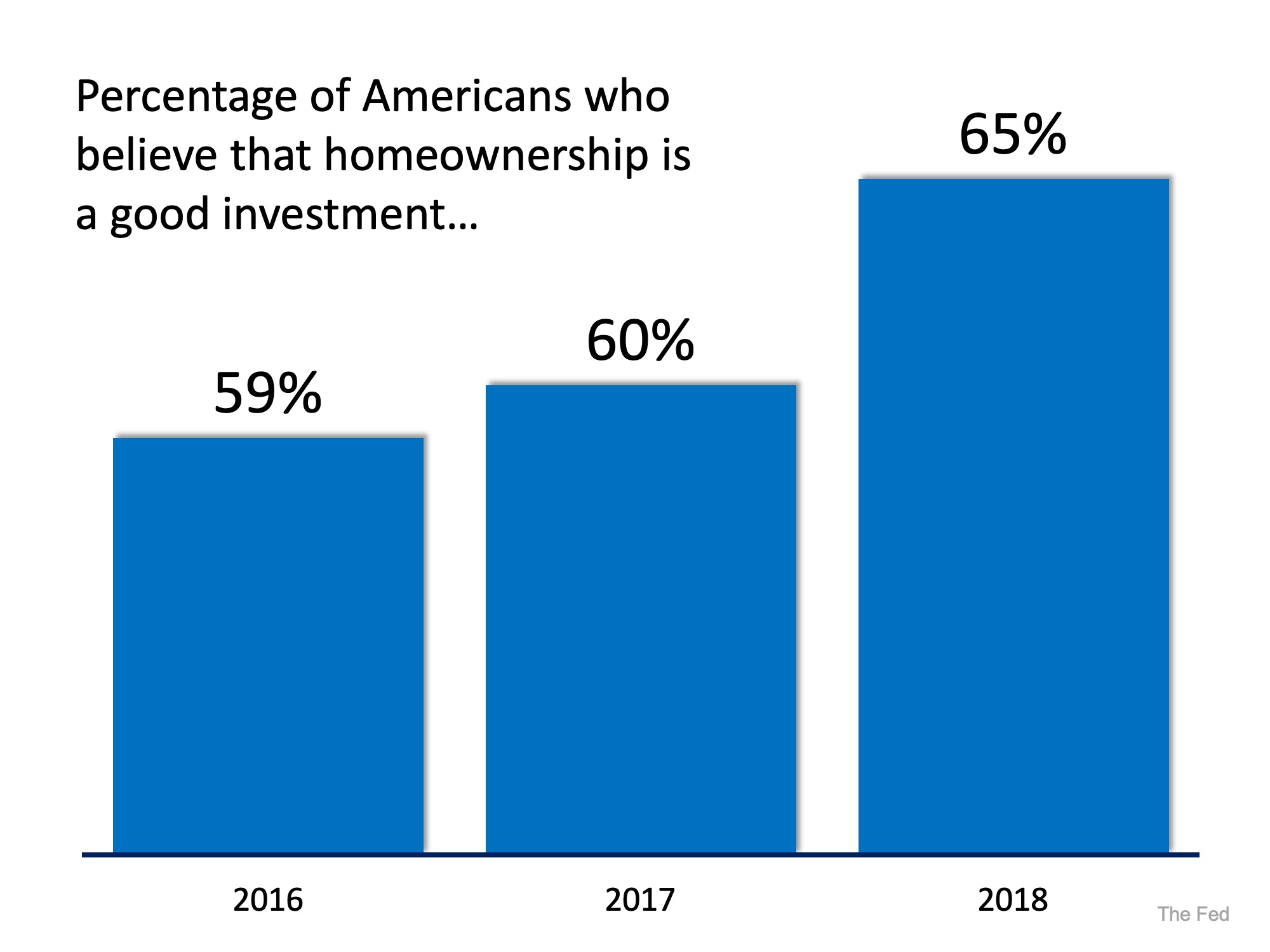

Is Owning A Home A Good Investment? The Data Says Most People Say YES!

Following last year’s real estate market was like riding a rollercoaster. The market started off strong in 2018 and then softened before finishing with a mild flurry. However, one thing that did not waiver was America’s belief that owning a home makes sense from a financial standpoint.

An end-of-the-year survey by the Federal Reserve Bank’s Center for Microeconomic Data revealed that:

“The majority of households continue to view housing as a good financial investment.”

And that percentage has increased over the last three years.

Bottom Line

Though there is some uncertainty as to how the real estate market will perform over the next twelve months, one thing remains very certain: America’s belief in homeownership.

Thinking About Buying A Home This Year? Here’s What To Keep An Eye On.

As we kick off the new year, many families have made resolutions to enter the housing market in 2019. Whether you are thinking of finally ditching your landlord and buying your first home or selling your starter house to move into your forever home, there are two pieces of the real estate puzzle you need to watch carefully: interest rates & inventory.

Interest Rates

Mortgage interest rates had been on the rise for much of 2018, but they made a welcome reversal at the end of the year. According to Freddie Mac’s latest Primary Mortgage Market Survey, rates climbed to 4.94% in November before falling to 4.62% for a 30-year fixed rate mortgage last week. Despite the recent drop, interest rates are projected to reach 5% in 2019.

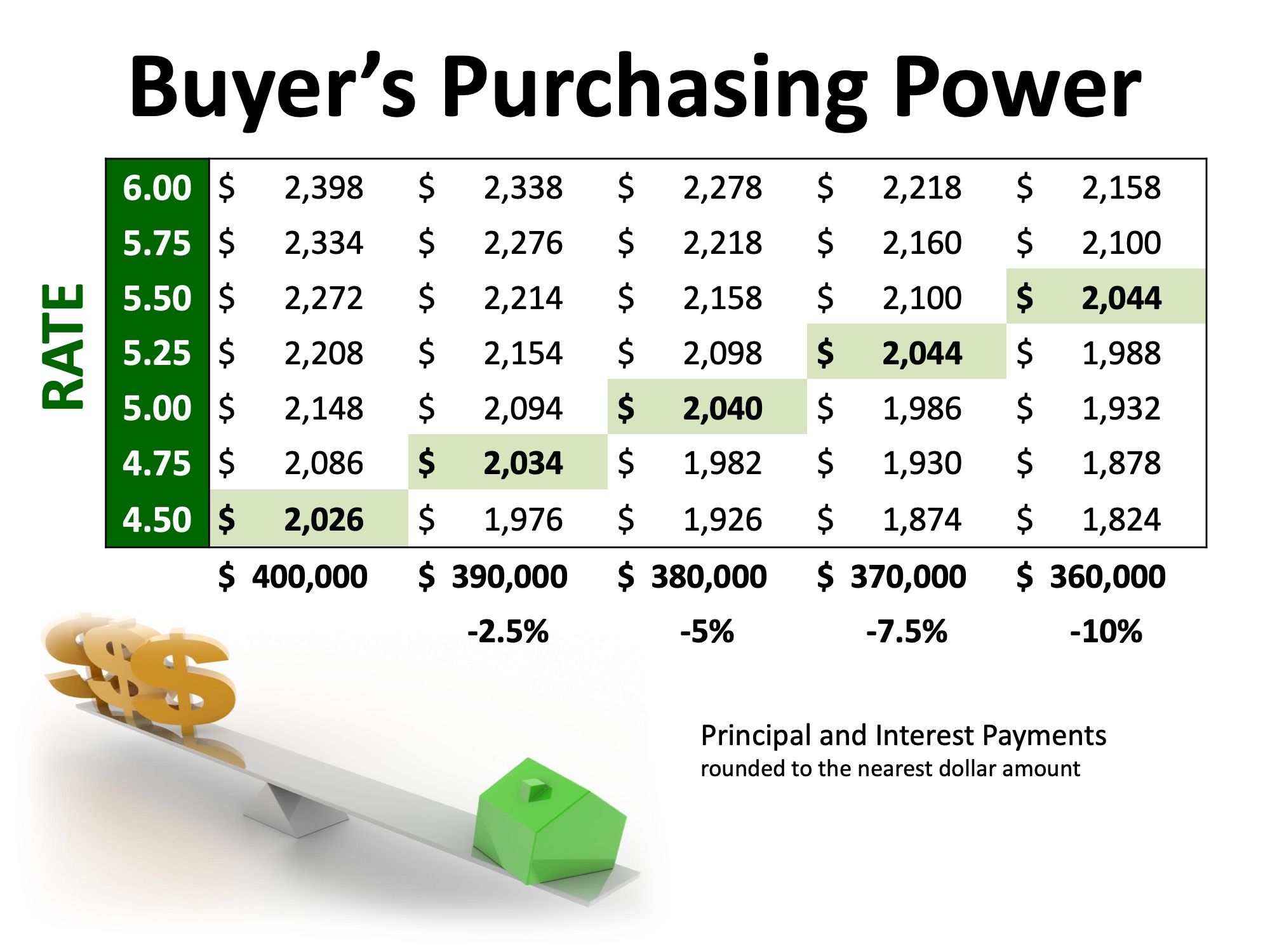

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford to buy will decrease if you plan to stay within a certain monthly housing budget.

The chart below shows the impact that rising interest rates would have if you planned to purchase a $400,000 home while keeping your principal and interest payments between $2,020-$2,050 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, $10,000).

Inventory

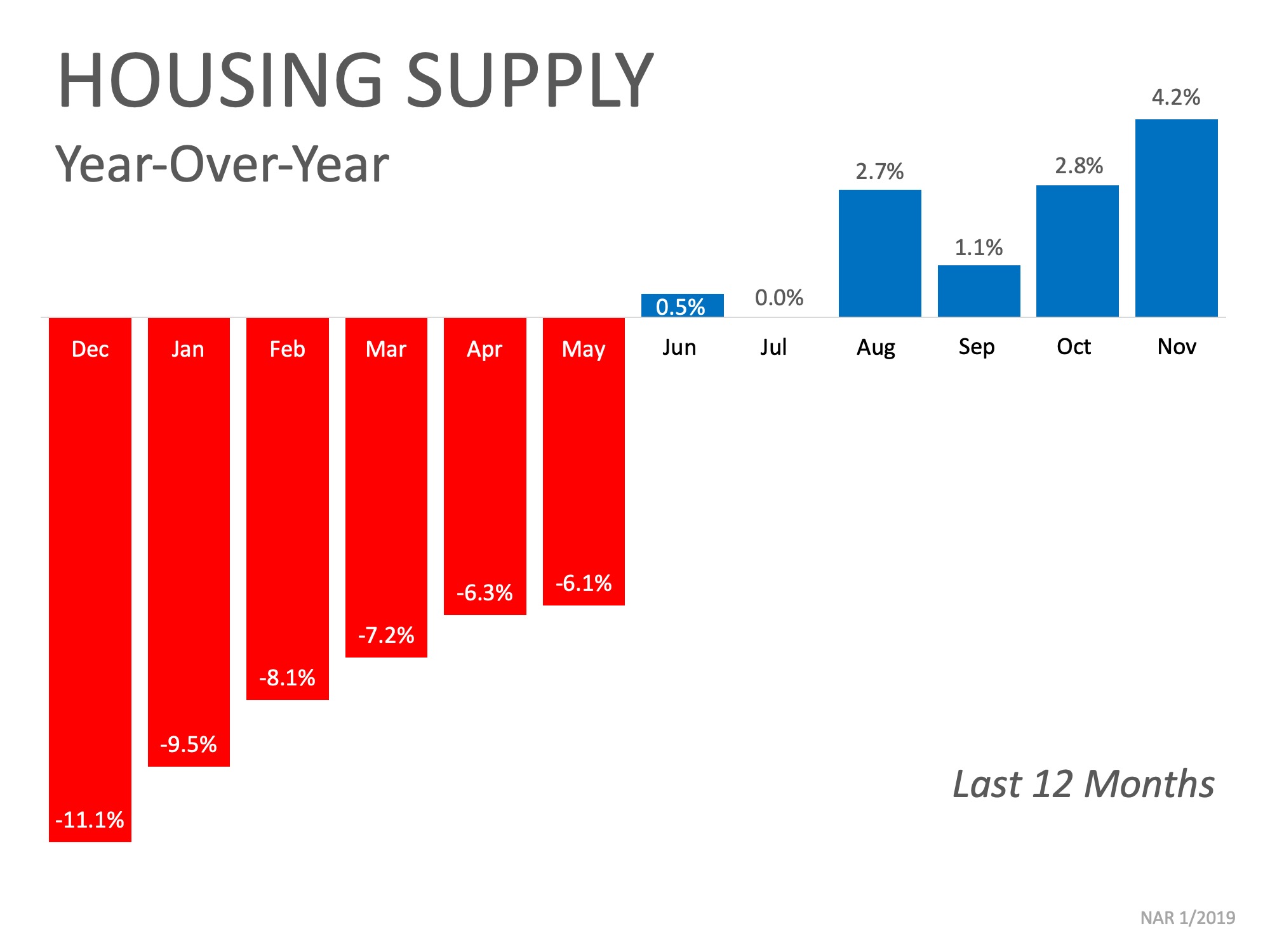

A ‘normal’ real estate market requires there to be a 6-month supply of homes for sale in order for prices to increase only with inflation. According to the National Association of Realtors (NAR), listing inventory is currently at a 3.9-month supply (still well below the 6-months needed), which has put upward pressure on home prices. Home prices have increased year-over-year for the last 81 straight months.

The inventory of homes for sale in the real estate market had been on a steady decline and experienced year-over-year drops for 36 straight months (from July 2015 to May 2018), but we are starting to see a shift in inventory over the last six months.

The chart below shows the change in housing supply over the last 12 months compared to the previous 12 months. As you can see, since June, inventory levels have started to increase as compared to the same time last year.

This is a trend to watch as we move further into the new year. If we continue to see an increase in homes for sale, we could start moving further away from a seller’s market and closer to a normal market.

Bottom Line

If you are planning to enter the housing market, either as a buyer or a seller, let’s get together to discuss the changes in mortgage interest rates and inventory and what they could mean for you.

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 13

- Next Page »

![Top Renovations to Complete Before You Sell Your House [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/01/03093809/201901104-STM-ENG-1046x1354.jpg)