Recent research shows that first-time homebuyers are buying homes in greater numbers than any time in the last few years. Also, renters in Knoxville are now realizing that they are also able to buy a home. If you are tired of seeing your friends and family diving head first into the real estate market, and wondering if now is the time for you to do the same, keep reading!

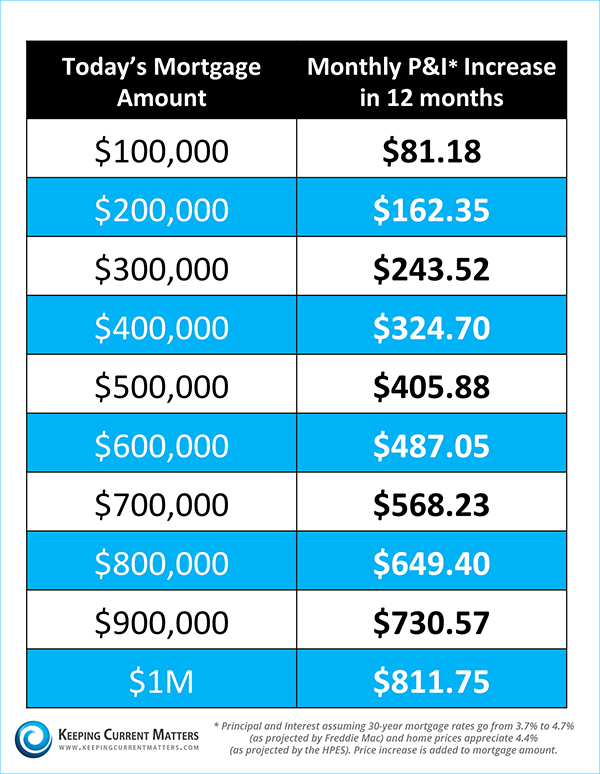

The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home, if prices and interest rates were to increase over a period of time.

Let’s see what that would look like for you by looking at an example of what the experts are predicting for the upcoming year. Let’s say you’re 30 years old and your dream house in Knoxville costs $250,000 today. Right now mortgage interest rates are at or around 4%.

Your monthly mortgage payment (principal & interest only) would be $1,193.54.

But you’re busy, you like your apartment, and moving is such a hassle. You decide to wait until next year to buy your Knoxville home. CoreLogic predicts that home prices will appreciate by 5.1% in the next 12 months; this means that same house you loved now costs, $262,750.

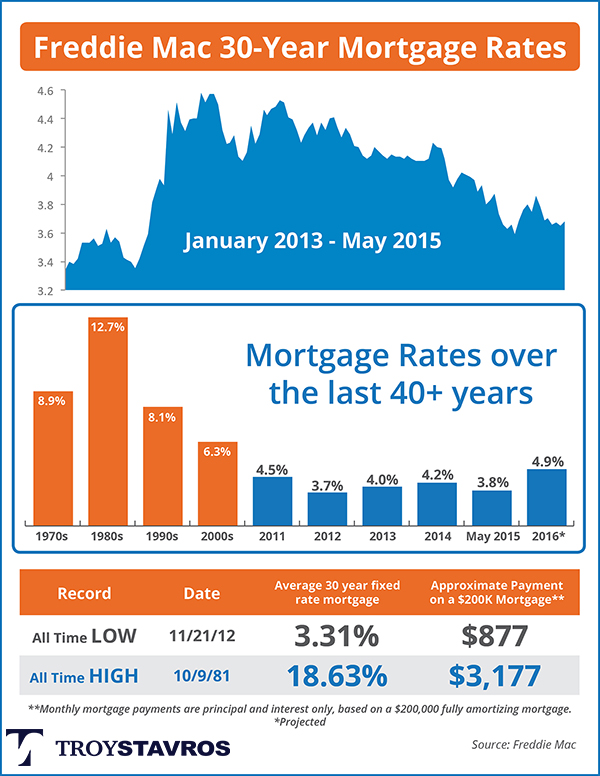

In turn, Freddie Mac predicts that over this same period of time, interest rates will be a full point higher at 5.0%. Your new payment per month is now $1,410.50.

The difference in payment is $216.96 PER MONTH!

That’s basically like taking $8 and tossing it out the window EVERY DAY!

Or you could look at it this way:

- Need a new car? You could get a brand new car for $217 a month.

Let’s look at that number annually. Over the course of your new mortgage at 5.0%, your annual additional cost would be $2,603.52!

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a bathroom update. I could come up with 100’s of ways to spend $2,603, and I’m sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $78,105.60, all because when you were 30 you thought moving in 2015 was such a hassle or loved your apartment too much to leave yet. Yeah, that’s pretty dramatic, but it’s true!

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready. But if they showed you that you could save $78,000 you’d at least listen to what they had to say.

They say hindsight is 20/20, I’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||