*IMPORTANT INFO ON 3 CURRENT SCAMS HAPPENING NATIONWIDE* I sat down with Linda Reitz-Hamm of Superior Title & Escrow to talk about 3 scams out there that homeowners, home sellers, and home buyers MUST be aware of. People are losing MASSIVE amounts of money (totaling in the BILLIONS), so you’ll want to educate yourself on these so you can see them coming, as they can look very legit. Have questions about this or anything else real estate related? Contact Troy Stavros with CornerStone Realty Associates at 888-388-DOOR xt.707.

Top 4 Home Improvement Projects That Net The Most Return On Investment

Some Highlights:

- If you are planning on listing your house for sale this year, here are the top four home improvement projects that will net you the most Return on Investment (ROI).

- Minor bathroom renovations can go a long way toward improving the quality of your everyday life and/or impressing potential buyers.

- Upgrading your landscaping or curb appeal helps get buyers in the door. These upgrades rank as the 2nd and 4th best renovations for returns on investment.

Are Homeowners Renovating to Sell or to Stay?

Over the past few years, two trends have emerged in the housing market:

- Home renovations have shot up

- Inventory of homes available for sale on the market has dropped

A ‘normal’ housing market is defined by having a 6-month supply of homes for sale. According to the latest Existing Home Sales Report from the National Association of Realtors, we are currently at a 4.4-month supply.

This low inventory environment has many current homeowners worried that they would be unable to find a home to buy if they were to list and sell their current houses, which is causing many homeowners to instead renovate their homes in an attempt to fit their needs.

According to Home Advisor, homeowners spent an average of $6,649 on home improvements over the last 12 months. If that number seems high, it also includes homeowners who recently bought fixer-uppers.

A new study from Zillow asked the question,

“Given a choice between spending a fixed amount of money on a down payment for a new home or fixing up their current home, what would you do?”

Seventy-six percent of those surveyed said that they would rather renovate their current homes than move. The results are broken down by generation below.

More and more studies are coming out about the intention that many Americans have to ‘age in place’ (or retire in the area in which they live). Among retirees, 91% would prefer to renovate than spend their available funds on a down payment on a new home.

If their current house fits their needs as far as space and accessibility are concerned, then a renovation could make sense. But if renovations will end up changing the identity of the home and impacting resale value, then the renovations may end up costing them more in the long run.

With home prices increasing steadily for the last 6.5 years, homeowners have naturally gained equity that they may not even be aware of. Listing your house for sale in this low-competition environment could net you more money than your renovations otherwise would.

Bottom Line

If you are one of the many homeowners who is thinking about remodeling instead of selling, let’s get together to help you make the right decision for you based on the demand for your house in today’s market.

Have the Smartest Home on the Block?

From security systems to thermostats, light bulbs to sprinklers, your home can easily become smarter with internet-enabled devices.

It’s going to be March before we know it! I hope 2017 is off to a great start for you.

I’m always looking for ways to help my clients improve the value of their homes. One of the things I’m seeing more often is people adding more smart technology to their homes – things like internet-connected cameras, appliances, lights, and even locks.

READ: Best Smart Home Devices of 2017

Is this something you’re doing in your home? Reply and let me know! I’m always looking for great ideas to share and I’d love to hear from you.

If I can be a resource to you in any way, please call or text any time. Here’s my number: 865-999-0925.

And, as always, if you know someone who’s thinking about buying or selling, I’d love to help them out. Share my phone number or my email address: troy@gablesandgates.com

Selling A Home During The Holidays..Naughty or Nice?

Selling a home during the holidays. Is is naughty or nice? Just about this time every year, scores of homeowners decide to wait until after the holidays to put their home on the market. Other homeowners, who currently have their homes on the market, decide to take them off the market until after the holidays. Here are six great reasons why that’s not a good idea:

- Relocation buyers! They are still out there and their companies are not concerned that it is holiday time. Plus if the buyers have kids, they’ll want them in school after the holidays.

- Home buyers that are looking for a home during the holidays are serious buyers and are ready to buy.

- You can restrict the showings on your home to the times you want it shown, so you remain in control of your schedule.

- Homes show better when decorated for the holidays.

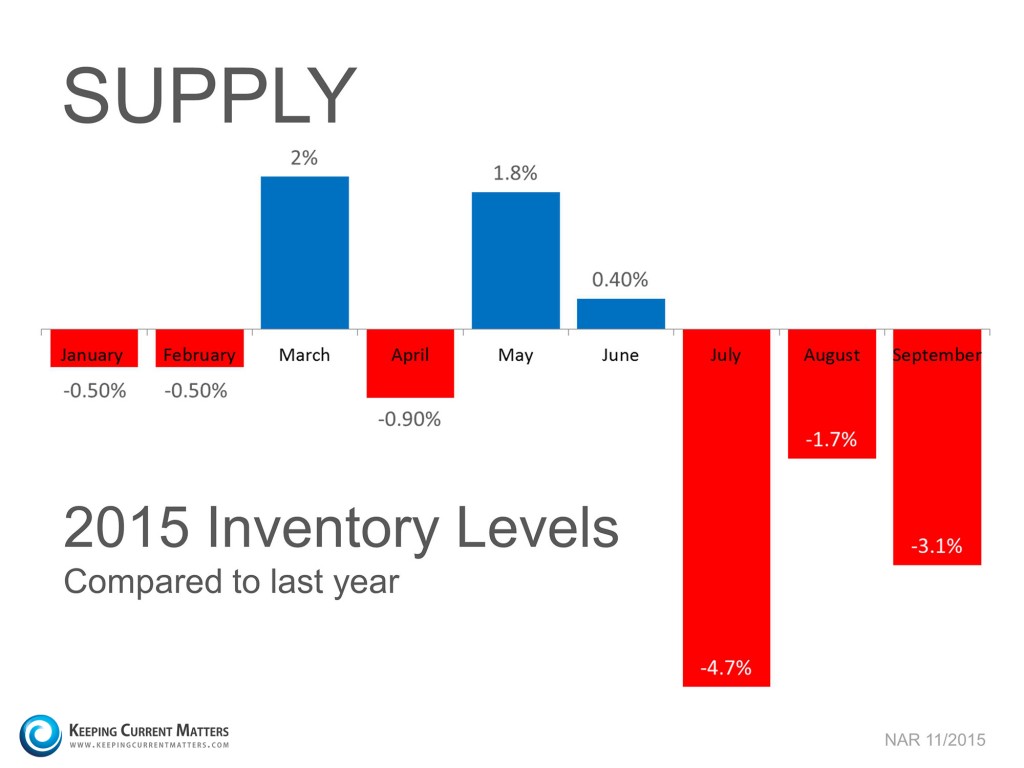

- There is less competition for you as a seller during the holidays. Let’s take a look at listing inventory as compared to the same time last year:

- The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will make a comeback in 2016. This will lessen the demand for your house.

What does this mean for you?

Waiting until after the holidays to sell your home probably doesn’t make sense.

Have questions or want to find out what your home is worth in today’s market? Call or text me, Troy Stavros with Gables & Gates, REALTORS at 865-599-9444.

What Is Equity In A Home? How Does It Help Build Wealth?

So what is equity in a home, and how does it help build wealth?

Citing a recent survey by Merrill Lynch, over 80% of the people in the United States believe that homeownership is still “an important part of the American Dream”.

One of the biggest reasons it’s seen as so important is that it helps build family wealth. Last week, Freddie Mac posted about the power of home equity. They defined home equity as:

“In the simplest terms, equity is the difference between how much your home is worth and how much you owe on your mortgage. You build equity by paying down your mortgage over time and through your home’s appreciation. In a nutshell, your money is working for you and contributing toward your financial future.”

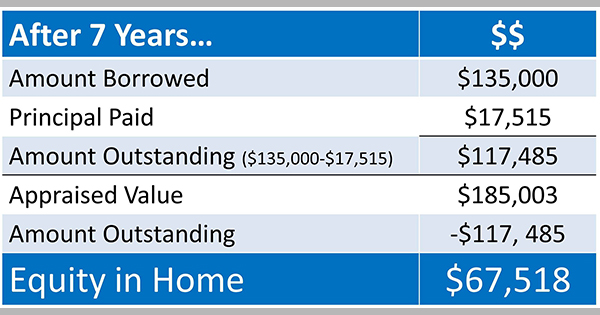

They then showed through a real life example, where a person bought a home for $150,000 with a down payment of 10%, leaving a loan amount of $135,000. The home buyer obtained a 30-year fixed-rate mortgage at 4.5% with a monthly mortgage payment of $684.03 (not including taxes and insurance). They then showed what would happen after just seven years of making their mortgage payment, assuming that the home appreciated 3% in value every year (the historic national average):

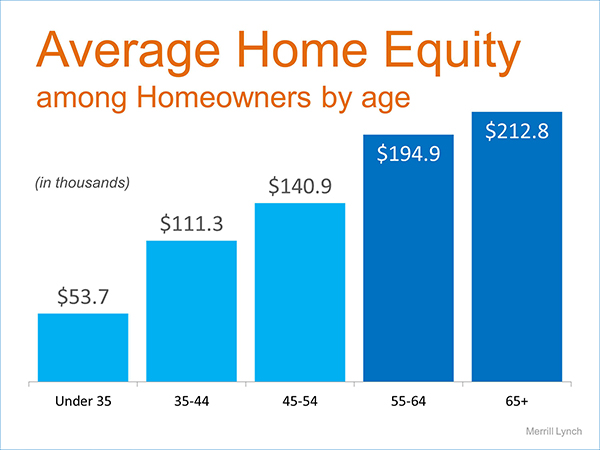

And the beauty of equity is that the “Equity in Home” dollar amount continues to build as long as you own the home. Merrill Lynch also published a report previously this year showing the average equity homeowners have acquired at certain age ranges.

What does this mean for you?

As a typical Amerian family, home equity is vitally important to building wealth. Referring to the first scenario above, Freddie Mac explained:

“Now, if you continued to rent, and made the same payment of $684.03 per month, you’d have zero equity and no means to build it.

Building equity is a critical part of homeownership and can help you create financial stability.”

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

![Top Renovations to Complete Before You Sell Your House [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/01/03093809/201901104-STM-ENG-1046x1354.jpg)