So what is equity in a home, and how does it help build wealth?

Citing a recent survey by Merrill Lynch, over 80% of the people in the United States believe that homeownership is still “an important part of the American Dream”.

One of the biggest reasons it’s seen as so important is that it helps build family wealth. Last week, Freddie Mac posted about the power of home equity. They defined home equity as:

“In the simplest terms, equity is the difference between how much your home is worth and how much you owe on your mortgage. You build equity by paying down your mortgage over time and through your home’s appreciation. In a nutshell, your money is working for you and contributing toward your financial future.”

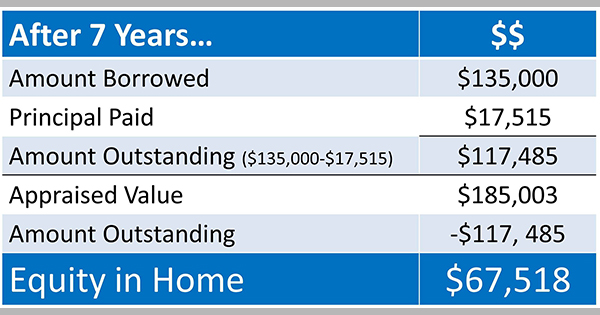

They then showed through a real life example, where a person bought a home for $150,000 with a down payment of 10%, leaving a loan amount of $135,000. The home buyer obtained a 30-year fixed-rate mortgage at 4.5% with a monthly mortgage payment of $684.03 (not including taxes and insurance). They then showed what would happen after just seven years of making their mortgage payment, assuming that the home appreciated 3% in value every year (the historic national average):

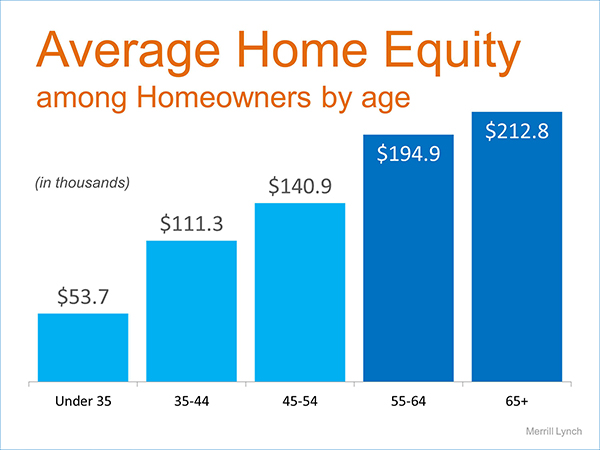

And the beauty of equity is that the “Equity in Home” dollar amount continues to build as long as you own the home. Merrill Lynch also published a report previously this year showing the average equity homeowners have acquired at certain age ranges.

What does this mean for you?

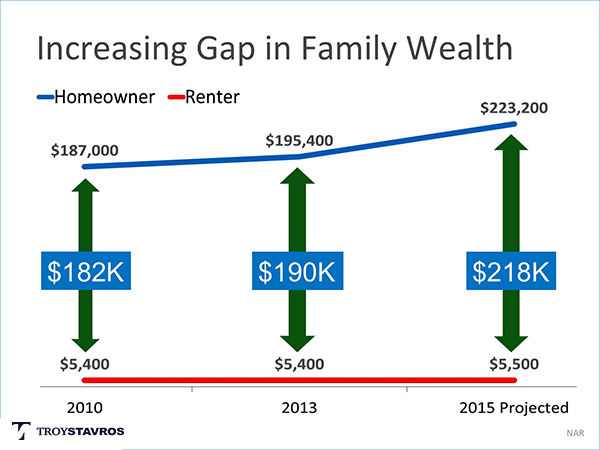

As a typical Amerian family, home equity is vitally important to building wealth. Referring to the first scenario above, Freddie Mac explained:

“Now, if you continued to rent, and made the same payment of $684.03 per month, you’d have zero equity and no means to build it.

Building equity is a critical part of homeownership and can help you create financial stability.”

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||