The top reason homeowners cited for not listing their home for sale in 2018, was their belief that they would be unable to find a home to buy. After 3 years of declining inventory for sale, we’re finally starting to see more listings come to market! Let’s get together to chat about what this means for our market! Call Troy Stavros with CornerStone Realty Associates at 888-388-3667 xt.707 or text to 865-999-0925 today!

Selling Your Home? Come On Down.. But Make Sure the Price is Right!

If you’ve ever watched “The Price is Right,” you know that the only way to win is to be the one to correctly guess the price of the item you want without going over! That means your guess must be just slightly under the retail price.

In today’s shifting real estate market, where more inventory is coming to market and home values are projected to appreciate at lower rates, homeowners will not be able to price their homes as aggressively as they were able to just last year.

They will have to employ the same strategy: be the closest without going over!

As we have explained before, pricing your home at or slightly below market value actually increases the number of buyers who will see your home in their search!

Over the last six months, more inventory has come to market while the months’ supply of inventory available has dropped. This means that the demand for homes to buy is still very strong throughout the country!

Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the homes when in reality nothing was wrong, the price was just too high!

Bottom Line

If you are thinking about listing your home for sale this year, let’s get together to properly price your home from the start! Contact Troy Stavros with CornerStone Realty Associates at 865-999-0925 to start formulating a plan to reach your real estate goals!

ACT SOON! Homes are a Bargain Compared to Historic Norms

A loaf of bread used to be a nickel. A movie ticket was a dime. Not anymore. Houses were also much less expensive than they are now. Inflation raised the price of all three of those items, along with the price of almost every other item we purchase.

The reason we can still afford to consume is that our wages have also risen over time. The better measure of whether an item is more expensive than it was before is what percentage of our income it takes to purchase that item today compared to earlier. Let’s look at purchasing a home.

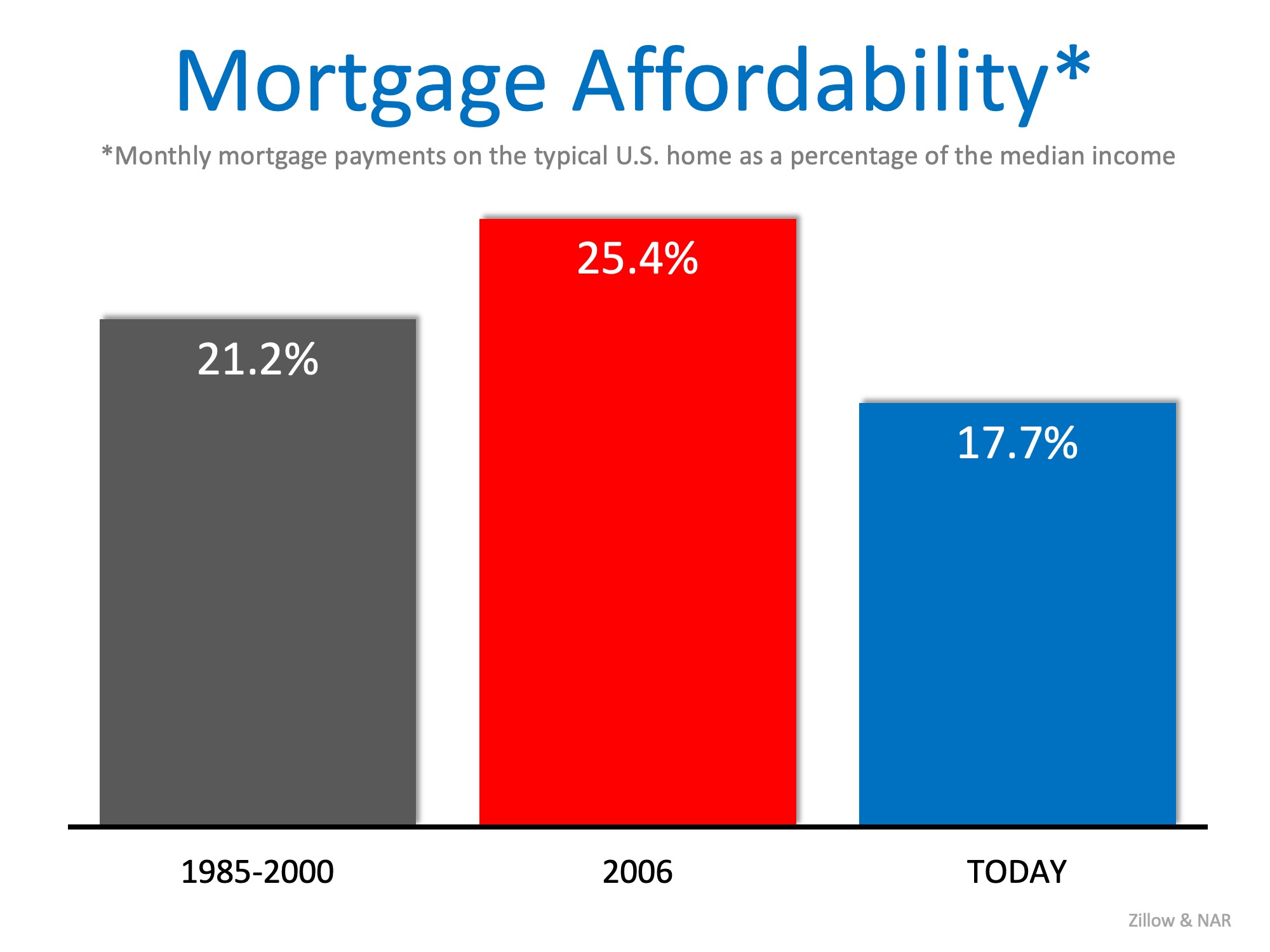

The COST of a home in Knoxville, Nashville, or anywhere for that matter, is determined by three major components: price, mortgage interest rate, and wages. The big question? Are we paying a greater percentage of our income toward our monthly mortgage payment today than previous generations? Surprisingly, the answer is no.

Historically, Americans have paid just over 21% of their income toward their monthly mortgage payment.

Though home prices are higher than before, wages have risen as well. And, the most important component in the cost equation – the mortgage rate – is dramatically lower than it was in the 1970s, 1980s, 1990s, and 2000s.

Today, according to the latest Home Affordability Index just released by the National Association of Realtors, Americans are paying 17.4% of their income toward their mortgage payment. That is much lower than the 21% average previous generations have paid.

Bottom Line

The cost of purchasing a home in Tennessee today, or nationally for that matter, is a bargain compared to previous generations when we look at it from a percentage of income basis. However, with mortgage rates expected to increase and home prices continuing to appreciate, that will not always be the case. Whether you are buying your first home or looking to move-up to a more expensive home, purchasing sooner rather than later probably makes sense. Contact Troy Stavros with CornerStone Realty Associates at 865-999-0925 to start formulating a plan and get you into your dream home!

The Best Time To List Your House, Might Be RIGHT NOW!

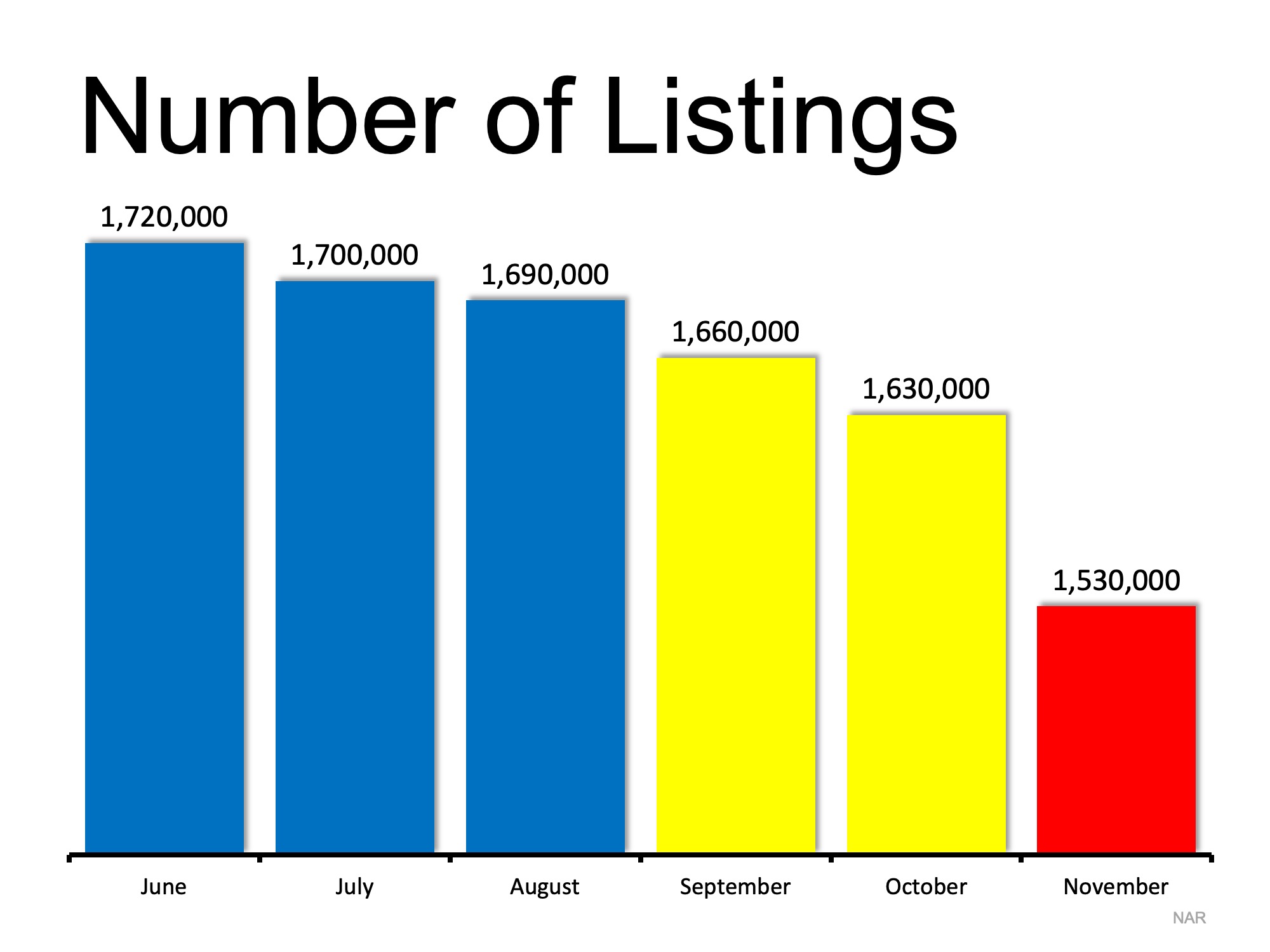

You may have heard that the housing market is softening. There is no doubt that buyer traffic has decreased. There are fewer purchasers in the market than there were last month and at this time last year. What you may not have heard, however, is that there is still a severe shortage of listing inventory in many regions of the country, in many price ranges.

In a recent interview discussing the housing market, First American’s Chief Economist Mark Fleming put it simply:

“The biggest challenge is really the availability of supply.”

When we look at available inventory numbers released by the National Association of Realtors(NAR), we see that the actual number of homes for sale has decreased in each of the last five months.

What does this mean to you as a seller?

The best time to sell is when there is less competition. That guarantees you a better price and fewer hassles in the transaction.

Bottom Line

If you are thinking of selling your house this year, the best time to put it on the market might be right now. Let’s get together to evaluate the demand for your house in our market! Contact Troy Stavros with CornerStone Realty Associates at 865-999-0925 to start formulating a plan to fulfill your real estate goals!

Mortgage Interest Rates Have Dipped Lately. Will The Lower Rates Stick Around?

Interest rates for a 30-year fixed rate mortgage climbed consistently throughout 2018 until the middle of November. After that point, rates returned to levels that we saw in August to close out the year at 4.55%, according to Freddie Mac’s Primary Mortgage Market Survey.

After the first week of 2019, rates have continued their downward trend. As Freddie Mac’s Chief Economist Sam Khater notes, this is great news for homebuyers. He states,

“Mortgage rates declined to start the new year with the 30-year fixed-rate mortgage dipping to 4.51 percent. Low mortgage rates combined with decelerating home price growth should get prospective homebuyers excited to buy.”

In some areas of the country, the combination of rising interest rates and rising home prices had made some first-time buyers push pause on their home searches. But with more inventory coming to market, continued price growth, and interest rates slowing, this is a great time to get back in the market!

Will This Trend Continue?

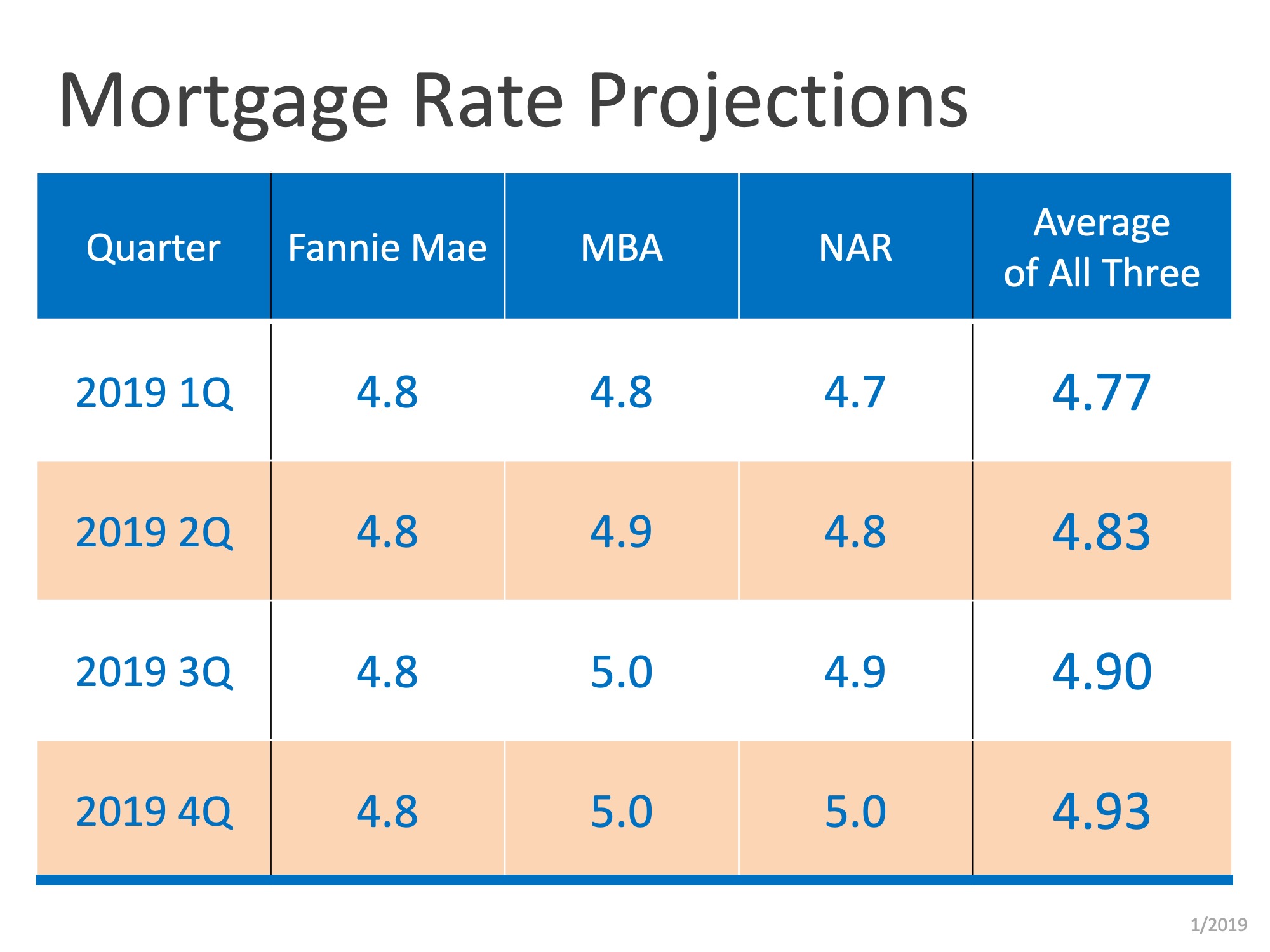

According to the latest forecasts from Fannie Mae, the Mortgage Bankers Association, and theNational Association of Realtors, mortgage rates will increase over the course of 2019, but not at the same pace they did in 2018. You can see the forecasts broken down by quarter below.

Bottom Line

Even a small increase (or decrease) in interest rates can impact your monthly housing cost. If buying a home in 2019 is on your short list of goals to achieve, let’s get together to find out if you are able to today. Contact Troy Stavros with CornerStone Realty Associates at 865-999-0925 to start formulating a plan and get you into your dream home!

3 Scams Targeting Homeowners, Home Sellers, and Home Buyers TODAY

*IMPORTANT INFO ON 3 CURRENT SCAMS HAPPENING NATIONWIDE* I sat down with Linda Reitz-Hamm of Superior Title & Escrow to talk about 3 scams out there that homeowners, home sellers, and home buyers MUST be aware of. People are losing MASSIVE amounts of money (totaling in the BILLIONS), so you’ll want to educate yourself on these so you can see them coming, as they can look very legit. Have questions about this or anything else real estate related? Contact Troy Stavros with CornerStone Realty Associates at 888-388-DOOR xt.707.

- « Previous Page

- 1

- …

- 19

- 20

- 21

- 22

- 23

- …

- 26

- Next Page »