Here are 2 BIG reasons why right now is the best time to buy your next home. Call me at 865-999-0925 to get the process started!

2 Mortgage Myths That Are Effecting Home Buyers

Fannie Mae’s “What do consumers know about the Mortgage Qualification Criteria?” Study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home.

Myth #1: “I Need a 20% Down Payment”

Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required.

Many believe that they need at least 20% down to buy their dream home. New programs actually let buyers put down as little as 3%.

Below are the results of a Digital Risk survey of Millennials who recently purchased a home.

As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%!

Myth #2: “I need a 780 FICO Score or Higher to Buy”

The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at the latest Ellie Mae Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.1% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will definitely make the mortgage process easier. Your dream home may already be within your reach. Have questions or want to get the process started? Contact me, Troy Stavros with Gables & Gates, REALTORS today at 865-777-9191 to setup a time to talk.

3 Questions Every Home Buyer Should Know The Answer To

VIDEO: There are 3 questions every potential home buyer should know the answer to. I give you the questions…and the answers. There are many potential home buyers still renting because they believe they can’t qualify for a mortgage. This information could be a game changer for them, as their is a lot of misinformation out there. Have questions? Contact me at 865-777-9191. Here is the link to the USDA site: http://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

Affordability May Not Be This Good For Too Long. It’s Time To Buy!

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates have stayed near historic lows.

Sellers should realize that waiting to make the move when mortgage rates are projected to increase probably doesn’t make sense. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain budget for your monthly housing costs.

Here is a chart detailing this point:

According to Freddie Mac, the current 30-year fixed rate is currently around 3.75%. With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, by $10,000).

Freddie Mac predicts that mortgage rates will be closer to 4.7% by this time next year.

Act now to get the most house for your hard-earned money.

What Is Equity In A Home? How Does It Help Build Wealth?

So what is equity in a home, and how does it help build wealth?

Citing a recent survey by Merrill Lynch, over 80% of the people in the United States believe that homeownership is still “an important part of the American Dream”.

One of the biggest reasons it’s seen as so important is that it helps build family wealth. Last week, Freddie Mac posted about the power of home equity. They defined home equity as:

“In the simplest terms, equity is the difference between how much your home is worth and how much you owe on your mortgage. You build equity by paying down your mortgage over time and through your home’s appreciation. In a nutshell, your money is working for you and contributing toward your financial future.”

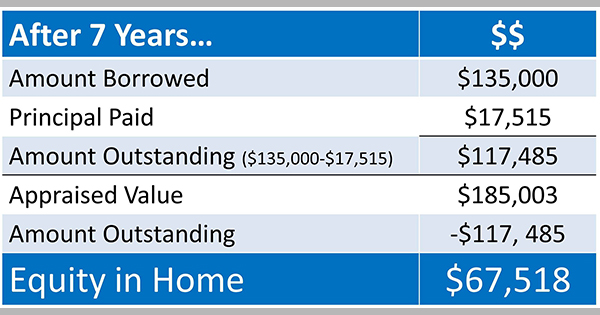

They then showed through a real life example, where a person bought a home for $150,000 with a down payment of 10%, leaving a loan amount of $135,000. The home buyer obtained a 30-year fixed-rate mortgage at 4.5% with a monthly mortgage payment of $684.03 (not including taxes and insurance). They then showed what would happen after just seven years of making their mortgage payment, assuming that the home appreciated 3% in value every year (the historic national average):

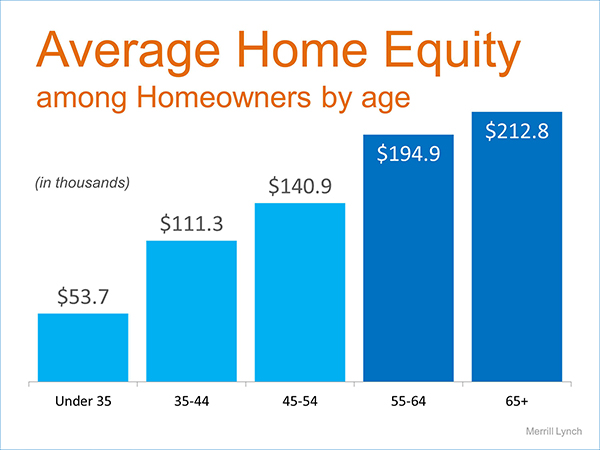

And the beauty of equity is that the “Equity in Home” dollar amount continues to build as long as you own the home. Merrill Lynch also published a report previously this year showing the average equity homeowners have acquired at certain age ranges.

What does this mean for you?

As a typical Amerian family, home equity is vitally important to building wealth. Referring to the first scenario above, Freddie Mac explained:

“Now, if you continued to rent, and made the same payment of $684.03 per month, you’d have zero equity and no means to build it.

Building equity is a critical part of homeownership and can help you create financial stability.”

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Renting in Knoxville? Stop Paying Your Landlord’s Mortgage!

Are you renting in Knoxville? It may be time to stop paying your landlord’s mortgage.

There are lots of folks out there that haven’t bought a home yet because they don’t feel comfortable taking on the commitment of a mortgage. What everyone needs to realize is that, unless you are living with your parents rent free, you are paying a mortgage – you’re either paying your own mortgage or your landlord’s.

The Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return.

That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Senior Vice President, Head of Single-Family Sales & Relationship Management at Freddie Mac, Christina Boyle, tells us of yet another benefit of getting a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As a homeowner, your mortgage payment is a form of ‘forced savings’ which allows you to have equity in your home that you can tap into later in life. Many people have trouble saving money consistently, so what better way to force savings than in a investment you can live in! As a renter, you guarantee the landlord is the person gaining all the equity.

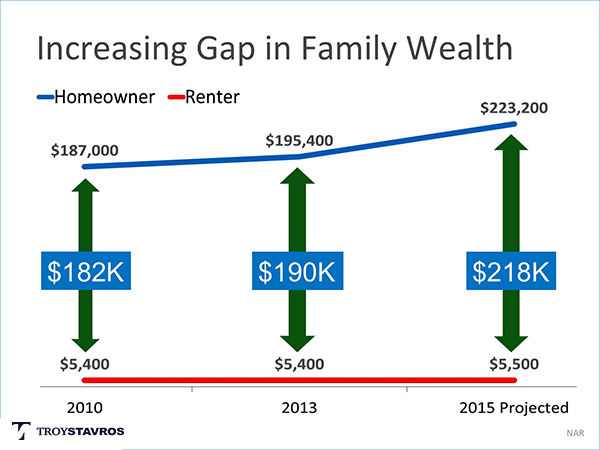

The illustration below shows the ever widening gap in net worth between homeowners and renters:

What does this mean for you?

Whether you are a first time home buyer or are thinking about buying a vacation home on the beach, owning might make more sense than renting, due to the fact that home values and interest rates are projected to rise.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- 19

- Next Page »