OPEN HOUSE THIS SUNDAY FROM 12-5PM! This will be the first available time to see this home so make plans to come out! Located at 6536 Airtree Lane, Knoxville, TN 37931. Super cute 2 story home tucked away in convenient West Knoxville location close to shopping, schools, etc. 3-minute walk to the neighborhood pool and clubhouse. Newer updates include a covered patio overlooking the completely fenced backyard and an updated HVAC system. Inside you’ll enjoy hardwood floors, crown molding, and a fireplace in the large family room. The kitchen with island features quartz counters, custom backsplash, and stainless steel appliances. An oversized formal dining room/flex space finishes off the main level. Upstairs you’ll find the owner’s suite complete with tray ceiling and a bath with updated shower with glass door, as well as double vanities, garden tub, and a walk-in closet. 2 additional bedrooms up plus a large bonus room which could serve as a 4th bedroom. OFFERED at $350,000.

Have questions or want to schedule a private showing? Contact the Troy Stavros TEAM at CornerStone Realty Associates at 865-999-0925

What Are Experts Saying About The 2022 Housing Market?

As we move into 2022, both buyers and sellers in East Tennessee are wondering, what’s next? Will there be more homes available to buy? Will East Tennessee home prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we turn to the experts. Here’s a look at what they say we can expect in 2022.

Odeta Kushi, Deputy Chief Economist, First American:

“Consensus forecasts put rates at about 3.7% by the end of next year. So, that’s still historically low, but certainly higher than they are today.”

Danielle Hale, Chief Economist, realtor.com:

“Affordability will increasingly be a challenge as interest rates and prices rise, but remote work may expand search areas and enable younger buyers to find their first homes sooner than they might have otherwise. And with more than 45 million millennials within the prime first-time buying ages of 26-35 heading into 2022, we expect the market to remain competitive.”

Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“With more housing inventory to hit the market, the intense multiple offers will start to ease. Home prices will continue to rise but at a slower pace.”

George Ratiu, Manager of Economic Research, realtor.com:

“We also expect a growing number of homeowners to bring properties to market, taking some pressure off high prices and offering buyers more options.”

Mark Fleming, Chief Economist, First American:

“Strong demographic demand will continue to act as the wind in the housing market’s sails.”

What Does This Mean for Buyers in East Tennessee?

Hope is on the horizon for 2022. You should see your options grow as more homes are listed and some of the peak intensity of buyer competition starts to ease. Just remember, rising rates and prices are a great motivator for you to find the home of your dreams sooner rather than later so you can buy while today’s affordability is still in your favor.

What Does This Mean for Sellers?

Make no mistake – this sellers’ market in East Tennessee will remain in 2022 as home prices are projected to continue climbing, just at a more moderate pace. Selling your house in East Tennessee while buyer demand is so high will truly put you in the driver’s seat. But don’t wait too long. With more listings projected to become available, your ideal window of opportunity to stand out from the crowd won’t last forever. Work with an agent who knows your local market and current inventory conditions to ensure you have the support you need to make an educated and informed decision about selling in the coming year.

Bottom Line

If you’re thinking of buying or selling, 2022 may be your year. Let’s connect to discuss your goals and the unique opportunities you have in today’s housing market.

Contact the Troy Stavros TEAM at CornerStone Realty Associates today at 865-999-0925 with questions or to get the process started.

The Perks of Putting 20% Down When Buying a Home in East Tennessee

If you’re thinking of buying a home in East Tennessee, you’re probably wondering what you need to save for your down payment. Is it 20% of the purchase price, or could you put down less? While there are lower down payment programs available that allow qualified buyers to put down as little as 0%, it’s important to understand the many perks that come with a 20% down payment.

Here are 4 reasons why putting 20% down may be a great option if it works within your budget.

1. Your Interest Rate May Be Lower

A 20% down payment vs. a 3-5% down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage interest rate they’ll likely be willing to give you.

2. You’ll End Up Paying Less for Your Home

The larger your down payment, the smaller your loan amount will be for your mortgage. If you’re able to pay 20% of the cost of your new home in East Tennessee at the start of the transaction, you’ll only pay interest on the remaining 80%. If you put down 5%, the additional 15% will be added to your loan and will accrue interest over time. This will end up costing you more over the lifetime of your home loan.

3. Your Offer Will Stand Out in a Competitive Market

In the East Tennessee market where many buyers are competing for the same home, sellers often like to see offers come in with 20% or larger down payments. The seller gains the same confidence as the lender in this scenario. You are seen as a stronger buyer with financing that’s more likely to be approved. Therefore, the deal will be more likely to go through.

4. You Won’t Have To Pay Private Mortgage Insurance (PMI)

What is PMI? According to Freddie Mac:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage.

It is not the same thing as homeowner’s insurance. It’s a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%. . . . Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment.”

As mentioned earlier, if you put down less than 20% when buying a home, your lender will see your loan as having more risk. PMI helps them recover their investment in you if you’re unable to pay your loan. This insurance isn’t required if you’re able to put down 20% or more.

Many times, home sellers looking to move up to a larger or more expensive home are able to take the equity they earn from the sale of their house to put 20% down on their next home. With the equity homeowners have today, it creates a great opportunity to put those savings toward a larger down payment on a new home.

Bottom Line

If you’re looking to buy a home in East Tennessee, consider the benefits of 20% down versus a smaller down payment option. Let’s connect so you have expert advice to help make your homeownership goals a reality.

Contact the Troy Stavros TEAM at CornerStone Realty Associates today at 865-999-0925.

Historic Home for Sale on the Historic Downtown Loudon Square

How about a Historic 100+ year old home on the square in Historic Downtown Loudon? Along the banks of the Tennessee River, you can take a step back in time and enjoy all the comforts of small-town living and then some. This charming multi-use facility was built in 1900 and has been remodeled/restored and is in outstanding condition. Located on the busy and revitalized Downtown Loudon Square, it sits directly across from the Loudon County Courthouse. Within a 5 minute stroll, you can enjoy multiple restaurants, shops, professional services, an ice cream parlor and more. Currently zoned commercial and on the docket for a possible zoning change to residential, this property could serve multiple uses. Office, coffee shop, antique shop, possible short-term rental, long-term rental, private residence, or shop/office with private residence above. Lots of possibilities. Public street parking in front and a private parking lot in the back. Don’t miss this amazing opportunity on a one-of-a-kind property.

The Average Homeowner in Tennessee Gained $53,000 in Equity over the Past Year

When you think of homeownership, what’s the first thing that comes to mind? Chances are you might focus on the non-financial benefits, like the security or stability that a home provides. But what about equity? While it can be overlooked, a homeowner’s equity helps build long-term wealth over time. Here’s a look at what equity is and why it matters.

For a homeowner, your equity is the current value of your home minus what you owe on the loan. So, as home values climb, your home equity does too. That’s exactly what’s happening today. There aren’t enough homes on the market to meet buyer demand, so bidding wars and multiple offers are driving prices up. That’s because people are willing to pay more to buy a home. Right now, this low supply and high demand are giving current homeowners a significant equity boost.

Dr. Frank Nothaft, Chief Economist at CoreLogic, explains it like this:

“Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home prices were up 17.7% for the past 12 months ending September, spurring the record gains in home equity wealth.”

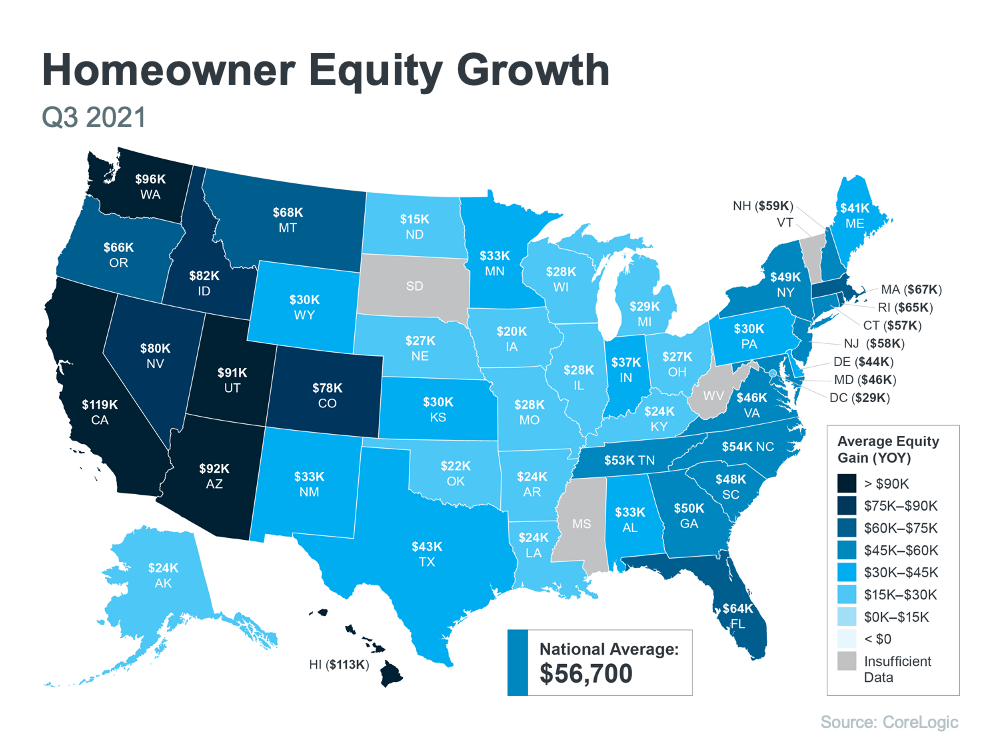

To find out just how much rising home values have impacted equity, we turn to the latest Homeowner Equity Insights from CoreLogic. According to that report, the average homeowner’s equity has grown by $56,700 over the last 12 months.

Curious how your Tennessee stacks up? Check out the map above and you’ll see our average is $53,000 in equity gained.

How Rising Equity Impacts You

If you’re already a homeowner in East Tennessee, equity not only builds your wealth, it also opens doors for you to achieve your goals. It works like this: when you sell your house, the equity you built up comes back to you in the sale. You can use those proceeds to fuel your next move, especially if you’ve decided your needs have changed and you’re looking for something new.

If you’re thinking about becoming a homeowner in East Tennessee, understanding the importance of equity can help you realize why homeownership is a worthwhile goal. It builds your wealth and gives you peace of mind that your investment is a wise one, not just from a lifestyle perspective, but from a financial one too.

Bottom Line

Whether you’re a current homeowner in East Tennessee or you’re ready to become one, it’s important to know how equity works and why it matters. If this inspires you to make a move, let’s connect to explore your options and find out what steps you need to take next.

Contact the Troy Stavros TEAM at CornerStone Realty Associates today at 865-999-0925.

East Tennessee Homebuyers: Be Ready To Act This Winter

To succeed as a buyer in today’s East Tennessee market, it’s important to understand which market trends will have the greatest impact on your home search. Danielle Hale, Chief Economist at realtor.com, says there are two factors every buyer should keep their eyes on:

“Going forward, the conditions buyers face are primarily dependent on two things: mortgage rates and housing supply.”

Here’s a look at each one.

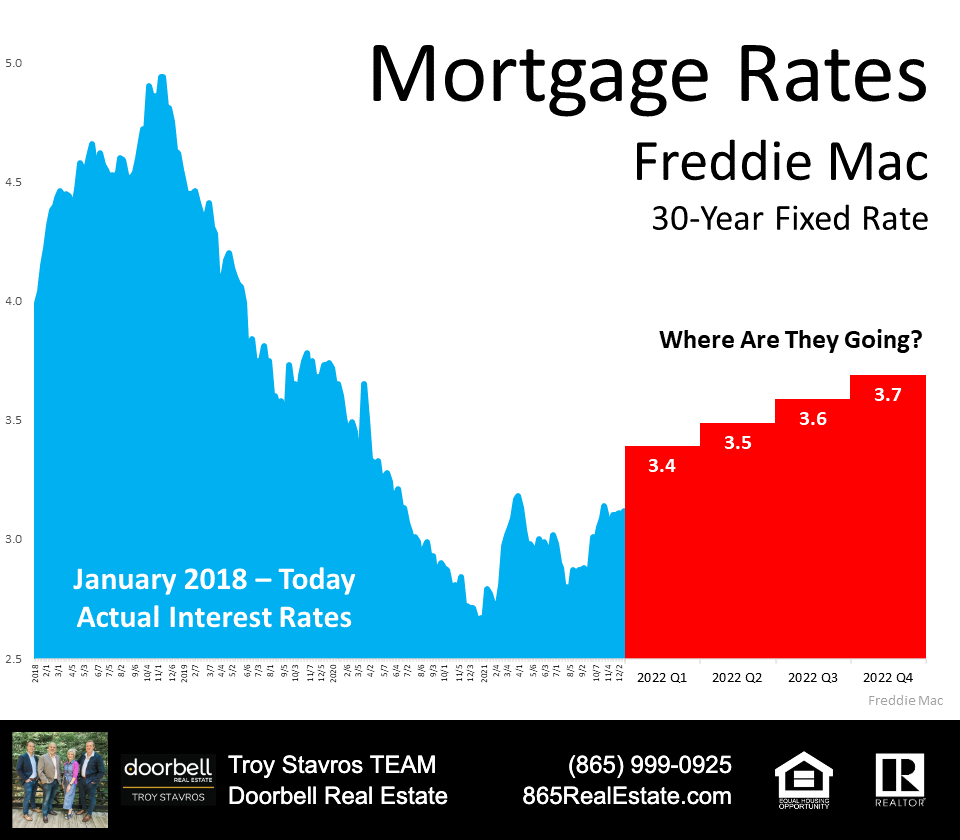

Mortgage Rates Projected To Rise in 2022

As a buyer, your interest rate directly impacts how much you’ll pay on your monthly mortgage when you purchase a home in East Tennessee. Rates are beginning to rise, and experts forecast they’ll continue going up in 2022 (see graph below): As the graph shows, mortgage rates are expected to climb next year. But they’re still low when you compare to where they were just a few years ago. That presents today’s buyers with some motivation to lock in a low mortgage rate before they climb higher.

More Homes Are Expected To Be Available This Season in East Tennessee

The other market condition buyers need to monitor is the number of homes available for sale today in East Tennessee. The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the current supply of inventory sits at just 2.4 months. To put that into perspective, a 6-month supply is ideal for a balanced market where there are enough homes to meet buyer demand.

However, there may be good news for buyers in East Tennessee who are waiting for more options. A recent realtor.com survey shows more sellers are planning to list their homes this winter, meaning more choices will likely be available soon.

What Does That Mean for You?

Even if your options improve some this season, it won’t significantly shift market conditions overnight. According to NAR, MANY more listings need to be available to move closer to a more neutral market:

“Given the average monthly demand . . . , 3.55 million homes should be on the market to meet a level of inventory equal to six months of demand, implying a shortage of homes for sale of 2.24 million.”

So remember, even with more homes expected to come to market this season, competition among buyers in East Tennessee will remain fierce as there still won’t be enough homes for sale to meet the current demand. That means you’ll need to act quickly when you’re ready to make an offer.

Bottom Line

If you’re planning on buying a home in East Tennessee this winter, more options are welcome news, but it doesn’t mean you should slow down. Let’s connect today so you have an expert on your side to help act as quickly as possible when the right home for you hits the market.

Contact us, the Troy Stavros TEAM at CornerStone Realty Associates at 865-999-0925 to get the process started today.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 40

- Next Page »