Home prices have appreciated considerably over the last five years. This has some concerned that we may be in for another dramatic correction. However, recent statistics suggest home values will not crash as they did a decade ago. Instead, this time they will come in for a soft landing.

The previous housing market was fueled by an artificial demand created by mortgage standards that were far too lenient. When this demand was shut off, a flood of inventory came to market. This included heavily discounted distressed properties (foreclosures and short sales).

Today’s market is totally different. Mortgage standards are tighter now than they were prior to the last boom and bust. There is no fear that a rush of foreclosures will hit the market. The Mortgage Bankers’ Association just announced that foreclosures are lower today than at any time since 1996.

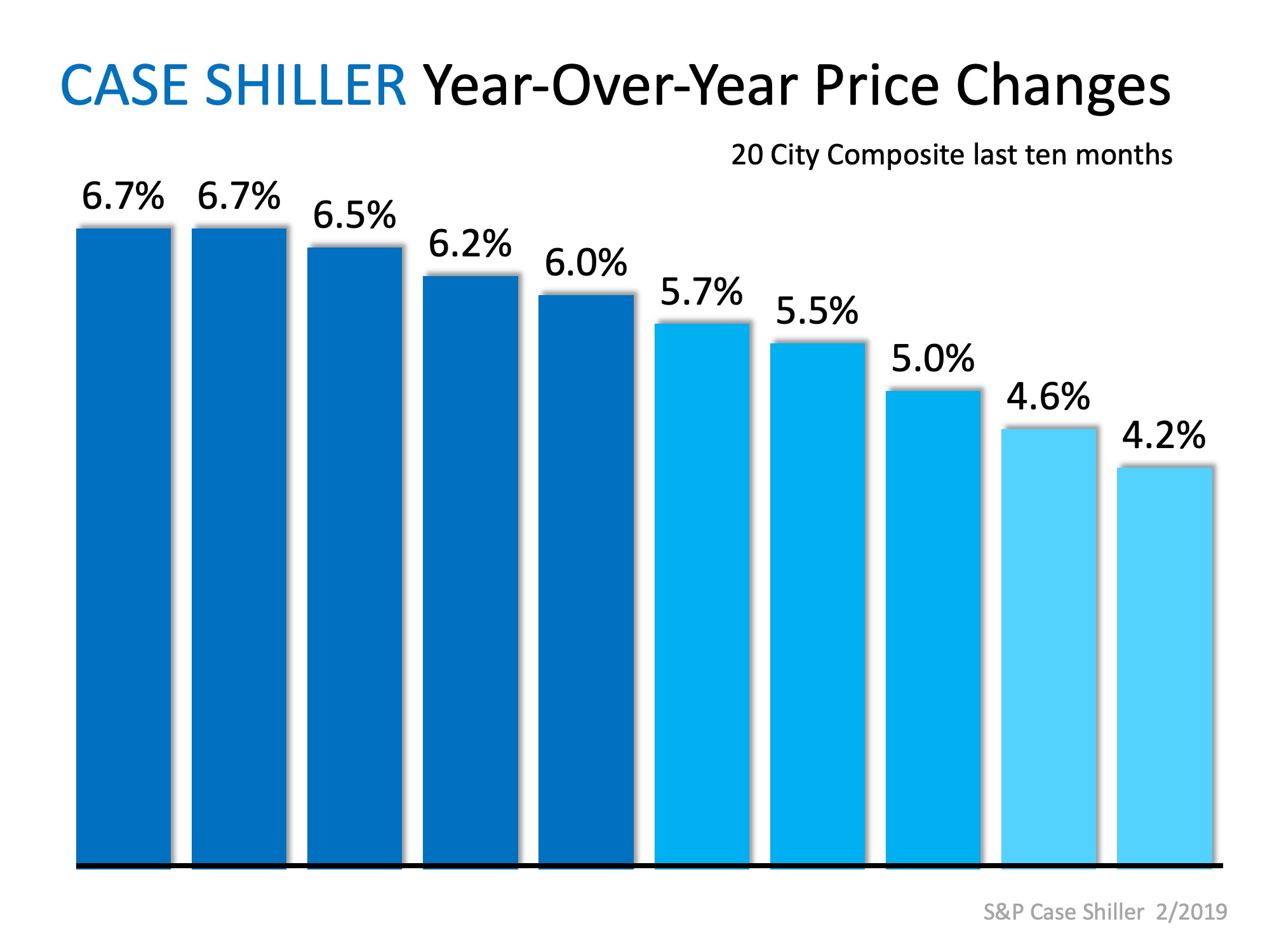

Case Shiller looks at the percentage of appreciation as compared to the same month the year prior. Here is a graph of their findings over the last ten months:

As we can see, home price appreciation is softening, as more inventory comes to the market. This shows that real estate prices are not crashing, but merely returning toward historic appreciation numbers, of 3.6% annually.

Bottom Line

Knoxville home prices are leveling off. Long term, that is a good thing for the housing market. Have questions about what your home’s value might be? Want to talk about what buying or selling a home might look like for your specific situation? Call me, Troy Stavros with CornerStone Realty Associates at 865-999-0925 today and let’s set up a time to sit down and talk.