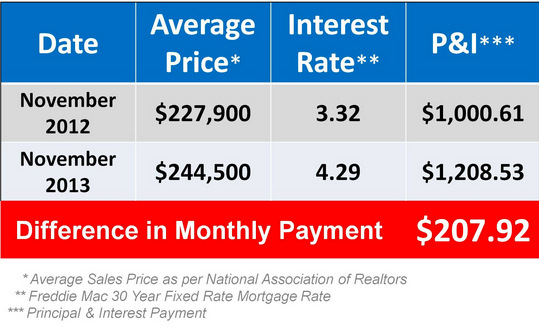

If you are in the process of buying a home in Knoxville or at least thinking about it, financing is also on your mind. Unless you are planning to pay cash, you’re going to want to find the best deal and the lowest mortgage rate. Knoxville mortgage rates can vary from lender to lender and also vary widely according to the type of mortgage and the length of the term.

“Although the difference in monthly payment between a 4.5 percent interest rate and a 5.5 percent interest is not as dramatic, your savings in interest paid over the life of the loan is significant,” said Erin Lantz, director of Zillow Mortgage Marketplace. “Mortgage rates will likely rise to 5 percent by the end of 2014 due to an improving economy and policy changes by the Federal Reserve. By buying a house while interest rates are still incredibly low, you could end up saving more than $52,000 over the course of 30 years.”