Cast your mind back to the real estate turbulence of 2008, a time when adjustable-rate mortgages (ARMs) commanded the spotlight. Fast forward to today, and ARMs are experiencing a resurgence in popularity among both seasoned homeowners and first-time buyers. Let’s delve into the reasons behind this shift and lay to rest any concerns it might evoke.

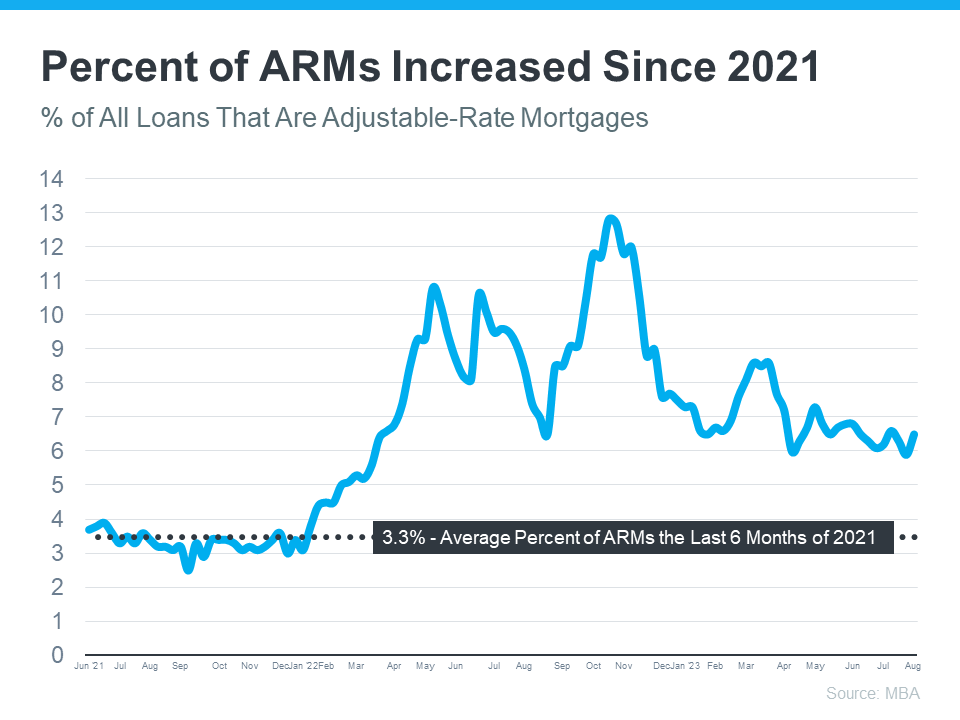

A visual representation of data from the Mortgage Bankers Association (MBA) serves as our guide, illustrating the gradual rise in the prevalence of adjustable-rate mortgages over recent years:

As the graph demonstrates, the landscape shifted from approximately 3% of all mortgages in 2021 to a notable increase in ARMs usage last year. The rationale behind this uptick is quite straightforward. With mortgage rates undergoing a significant climb, homeowners found solace in the ARMs option. The allure was simple: ARMs provided a way to secure lower interest rates in a climate where conventional borrowing costs were peaking.

Now, let’s debunk any misconceptions right away – the ARMs of today are not the same as the ones that contributed to the 2008 housing crisis. A pivotal factor behind that crisis was the lax lending standards prevailing at the time. Borrowers could obtain ARMs without substantiating their employment, income, or assets – a recipe for financial instability. This approach landed many homeowners in hot water, as they grappled with loans they were never truly qualified for.

In this iteration, lending standards have undergone a transformation. The financial sector has heeded the lessons from history, implementing stringent verification procedures for income, assets, and employment. In essence, modern-day borrowers are required to qualify for their loans, establishing their capacity to repay.

Archana Pradhan, an Economist at CoreLogic, elucidates the evolution:

“About 60% of Adjustable-Rate Mortgages (ARM) originated in 2007 were granted with minimal or no documentation… Similarly, in 2005, 29% of ARM borrowers had credit scores below 640… At present, nearly all conventional loans, including both ARMs and Fixed-Rate Mortgages, mandate comprehensive documentation, amortization, and are extended to borrowers with credit scores above 640.”

To make this crystal clear, let’s put it in layman’s terms, as described by Laurie Goodman at Urban Institute:

“The Adjustable-Rate Mortgages available today carry no more risk than other mortgage products, and their lower monthly payments could potentially widen access to homeownership for a larger pool of prospective buyers.”

For those concerned that today’s ARMs might resemble the previous crisis triggers, take comfort in knowing that the dynamics have shifted significantly this time around.

And for those venturing into the realm of homeownership for the first time, seeking viable lending options to navigate today’s affordability challenges, consider reaching out to a trusted lender. They stand ready to guide you through the intricate landscape of modern real estate financing.”