Buying a home now may save you $100’s of dollars per month. This holds true for any buyer, but especially those who are not paying cash. The reason it effects those financing their new home, is that there are two factors that impact the amount of home you can afford. Those two factors are home prices and mortgage rates. Let’s take a look at what the experts are predicting over the next year for those two important factors:

Buying a home now may save you $100’s of dollars per month. This holds true for any buyer, but especially those who are not paying cash. The reason it effects those financing their new home, is that there are two factors that impact the amount of home you can afford. Those two factors are home prices and mortgage rates. Let’s take a look at what the experts are predicting over the next year for those two important factors:

Home Prices

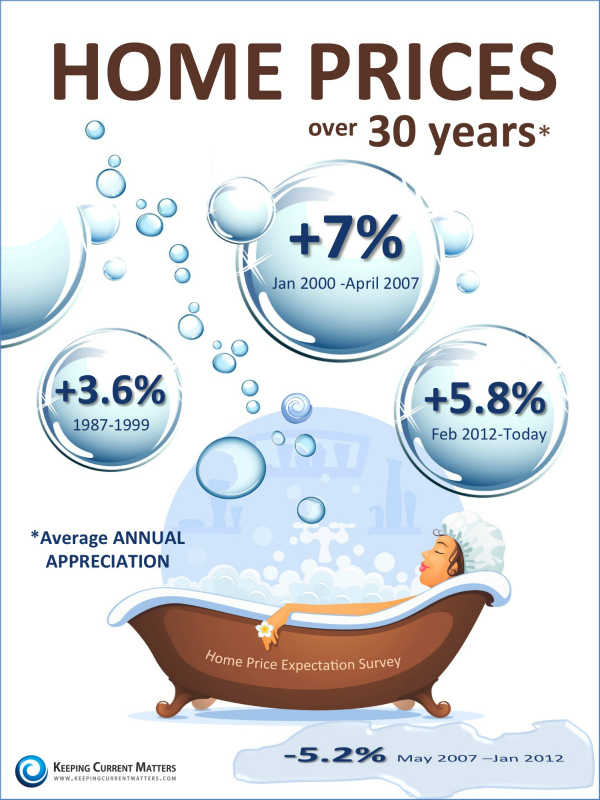

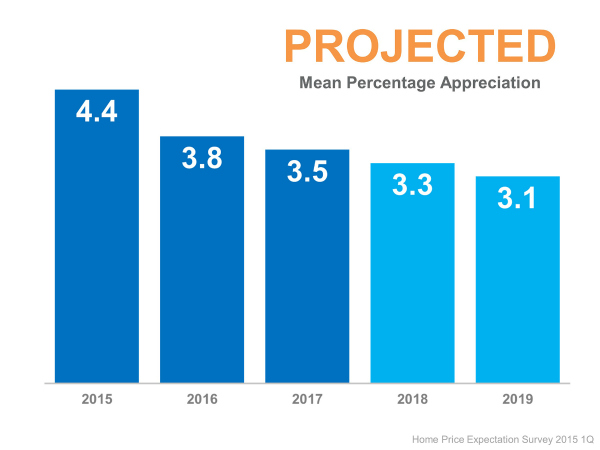

100+ economists along with investment strategists, market strategists, and real estate experts were recently polled for the “Home Price Expectation Survey”. The goal of the survey was to find out where home prices are headed over the next year. The results of the survey showed that the average home price appreciation projected over the next 12 months is approximately 4.4%.

Mortgage Interest Rates

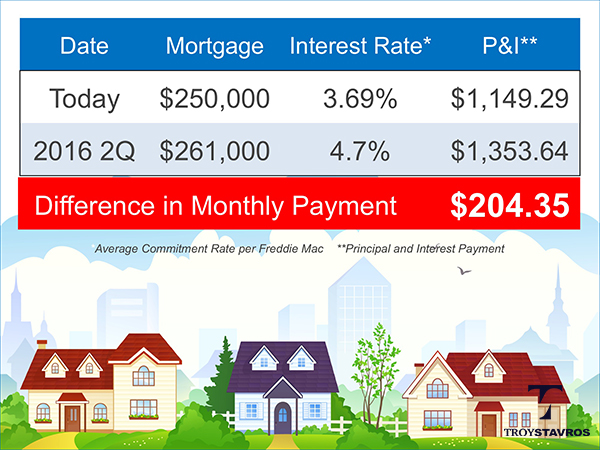

Freddie Mac’s latest “Economic & Housing Market Outlook” predicted that the 30 year fixed mortgage rate, one year from now, will be at 4.7%. Last week this same rate was at 3.69%.

What does this mean for you?

Let’s look at a couple scenarios. If you are buying a home in Knoxville priced at $250,000, the chart below shows you how much more you could be paying on a monthly basis, if you choose to wait until next year to buy a home:

Let’s say you are moving up to a higher priced home. What does it look like if you are buying a home in Knoxville for $500,000. How would it change your monthly payment?

Hopefully this helps you see how waiting to buy a home can not only make a big impact on how much home you can afford, but also what a direct impact it can have on your monthly finances. Have questions? Comments? Want to talk about getting started in searching for your next home in Farragut or Knoxville? Need to get your current home sold first? Contact me, Troy Stavros with Gables & Gates, REALTORS and I’d love to sit down and talk about the process and how to help you reach your goals. I’m here to serve you!