Did you know that buying a home in Farragut or Knoxville can now be done with only a 3% down payment? In an effort to open up the possibility of home ownership to more Americans, Freddie Mac and Fannie Mae have both launched programs only requiring a 3% down payment. While Fannie Mae’s program is limited to first time home buyers or buyers who haven’t owned a home in the past 3 years, Freddie Mac’s program does NOT have these limitations. Freddie Mac has what they are calling the Home Possible Advantage Mortgage. In their own words it is: “An affordable, conforming, conventional mortgage with a 3% downpayment requirement designed to make responsible homeownership accessible to more first-time buyers and other qualified borrowers with limited downpayment savings.”

Did you know that buying a home in Farragut or Knoxville can now be done with only a 3% down payment? In an effort to open up the possibility of home ownership to more Americans, Freddie Mac and Fannie Mae have both launched programs only requiring a 3% down payment. While Fannie Mae’s program is limited to first time home buyers or buyers who haven’t owned a home in the past 3 years, Freddie Mac’s program does NOT have these limitations. Freddie Mac has what they are calling the Home Possible Advantage Mortgage. In their own words it is: “An affordable, conforming, conventional mortgage with a 3% downpayment requirement designed to make responsible homeownership accessible to more first-time buyers and other qualified borrowers with limited downpayment savings.”

I meet plenty of folks who would love to own their own home, but have not had the ability, because of many different circumstances, to save up 10 or 20% for a down payment. This could be a game changer for them!

According to Dave Lowman, Executive Vice President of Single-Family Business at Freddie Mac: “Home Possible Advantage gives qualified borrowers with limited downpayment savings a responsible path to homeownership and lenders a new tool for reaching eligible working families ready to own a home of their own. Home Possible Advantage is Freddie Mac’s newest effort to foster a strong and stable mortgage market.” Lowman continued: “There’s a new reason Realtors and lenders may expect more qualified borrowers at the closing table during this spring’s home buying season. In addition to low mortgage rates and rising job growth, the down payment hurdle is starting to shrink for creditworthy borrowers, including first-time homebuyers.”

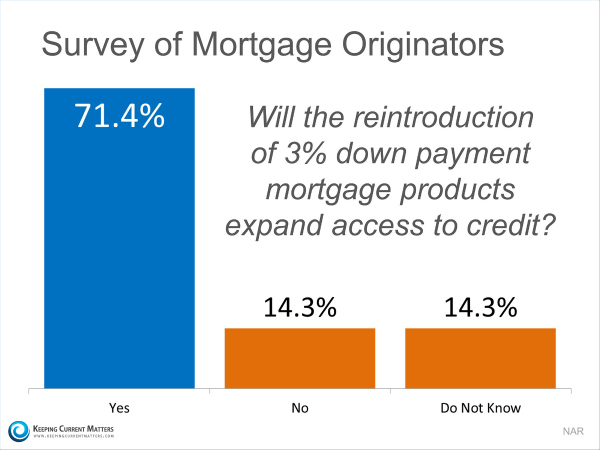

It appears that Lowman is in agreement with the mortgage industry, as a recent survey conducted by the National Association of REALTORS, while polling mortgage professionals, showed that most loan officers feel that the ability to offer a lower downpayment option will increase access to mortgage money. Here is what the survey found:

Here are some key facts about the Home Possible Advantage Program:

- Home Possible Advantage offers qualified low- and moderate-income borrowers a conforming conventional mortgage with a maximum loan-to-value ratio of 97 percent.

- Home Possible Advantage mortgages can be used to buy a single unit property or for a “no cash out” refinance of an existing mortgage.

- First time homebuyers must participate in an acceptable borrower education program, like Freddie Mac’s CreditSmart®, to qualify for Home Possible Advantage.

- Home Possible Advantage mortgages are available as 15-, 20-, and 30-year fixed rate mortgages.

Here are some answers to frequently asked questions:

- Can first-time buyers use the 97% LTV program to purchase a home? Yes. The 97 percent program can be used by first-time buyers. It can also be used by repeat buyers.

- How can I come up with the money for down payment and closing costs? Ways to come up with the down payment are using your own savings or using “gift funds.” Acceptable donors of gift funds are your fiancée, domestic partner, spouse, child or other dependent, or any individual related to you by blood, marriage, adaption or legal guardianship.

- Is the low-downpayment mortgage program via Fannie Mae and Freddie Mac better than a FHA loan? What’s best for one home buyer may not be what’s best for another. Each program has its benefits. I would be happy to introduce you to our preferred lender who can counsel you to find out which program would work best for your situation.

- What is the loan limit on the 3% down program through Fannie Mae and Freddie Mac? The 3% downpayment program is limited to loan sizes of $417,000 or less. Loans in higher-cost areas are permitted, but loan sizes remain capped at local conforming loan limits.

- Can this program be used to refinance my current home? YES. Eligible homeowners who wish to refinance their current mortgage can refinance their loan up to the 97% loan to value level. There are certain limitations so check with our preferred mortgage professional for details.

- Are vacation homes eligible under the 3% downpayment program? No, the 3% downpayment program is for primary residences only. Vacation and second homes are not allowed.

- Can the 3% downpayment program be used for investment properties? No, the 3 percent down-payment program is for primary homes only. Investment properties are not allowed.

- Is private mortgage insurance required with the 97% mortgage program? Yes, mortgage applicants are required to pay private mortgage insurance (PMI) as part of the 97% mortgage program. Your mortgage lender will arrange for your mortgage insurance policy at the time of application.

- Will low down payment loans cause another housing collapse like the sub-prime mortgages did? I say no and here is why. Unlike the problem loans of the past, the level of documentation required to obtain these loans is far more in depth. Prospective buyers will be expected to document all details of their financial situation with everything from income, employment, and financial documentation. And while today’s credit standards have loosened over the past two years, they are still much higher than they were at the time of the collapse. So while homebuyers can once again obtain a loan with a low down payment, they will do so by being held to a higher standard.

What does this mean for you?

If you’ve been on the sidelines, wishing you could get into the homeownership game, but haven’t had the downpayment to do so. It’s time to put on your helmet! With this new 3% down payment option, you should be able to take a big step towards fulfilling your dream of owning your own home. For those who already own their home, it might give you the flexibility to move up into home that might better suit your current living situation. If you have any questions, as always, don’t hesitate to contact me, Troy Stavros with Gables & Gates, REALTORS. I’m here to serve you!