Are you ready to get out of an apartment and into something larger? Searching homes for rent Knoxville TN? You might want to think twice about that. Here is why. A recent study by the National Association of REALTORS® that studied “income growth, housing costs and changes in the share of renter and owner-occupied households over the past 5 years in metropolitan statistical areas throughout the U.S.,” showed that over the last 5 years, average rent rose 15%, yet the income of the renters only rose 11%. For those currently renting, the difference between rent and income could get you stuck in a place where it becomes impossible for you to save up the funds for a down payment on a home.

Are you ready to get out of an apartment and into something larger? Searching homes for rent Knoxville TN? You might want to think twice about that. Here is why. A recent study by the National Association of REALTORS® that studied “income growth, housing costs and changes in the share of renter and owner-occupied households over the past 5 years in metropolitan statistical areas throughout the U.S.,” showed that over the last 5 years, average rent rose 15%, yet the income of the renters only rose 11%. For those currently renting, the difference between rent and income could get you stuck in a place where it becomes impossible for you to save up the funds for a down payment on a home.

THE BENEFITS OF HOME OWNERSHIP

One of the biggest benefits of homeownership is the ability to protect yourself from rising rents and have a fixed dollar amount for your housing costs for the life of your mortgage. Did you know that there is a good chance that your monthly living expenses will go down if you buy a home? That’s right! Many buyers find that their mortgage payments are less than what they were paying in rent.

The other huge benefit of home ownership is forced savings and building your net worth. The Federal Reserve conducts the “Survey of Consumer Finances” every 3 years where they collect data across all social and economic groups. Here are some of their findings:

- The average American family has a net worth of $81,200.

- 61.4% or $49,856 of that net worth is home equity.

- A homeowner’s net worth is 36X greater than a renters!

- The average renter has a net worth of $5400 while the average homeowner has a net worth of $194,500.

THE REAL DIFFERENCE BETWEEN RENTING AND OWNING

You might be asking yourself why the numbers above are so different. Here is a practical example. A renter, who has rented year after year, is paying their landlord’s mortgage for them. We know that over that last 5 years rent has risen by 15%. So each year the renter is paying more rent to their landlord, yet that renter’s income might not be rising at the same pace as their rent. Therefore over time it effects their net worth negatively. A homeowner on the other hand, has a fixed dollar amount to pay for their housing, because they locked in their interest rate and monthly mortgage payment for up to 30 years when they purchased their home. When they pay their mortgage payment every month, a portion of that payment goes to interest (to pay the bank) and the other portion goes to principal (which pays down the balance of their loan). Whether or not their income increases or not, we know that home values are projected to increase by an average of 3.5% per year for the next 5 years. As the homeowner pays down their balance and the value of their home increases, this builds their home equity, which in turn builds their net worth. It’s no wonder that billionaire investor, John Paulson, recently stated, “I still think, from an individual perspective, the best deal investment you can make is to buy a primary residence that you’re the owner-occupier of.” (you can read that article HERE)

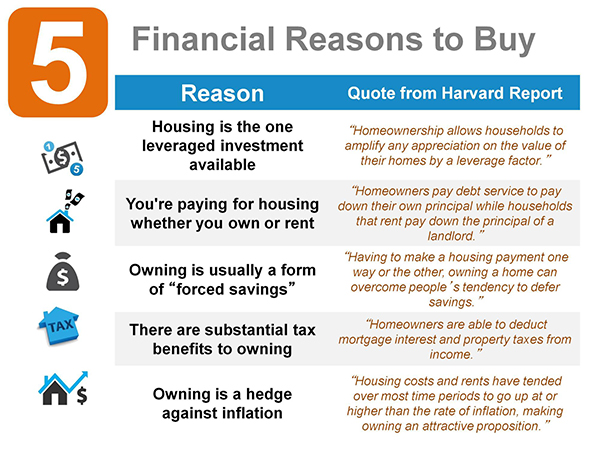

If the example above wasn’t convincing enough, here are 5 financial reasons to buy a home.

I CAN’T QUALIFY FOR A MORTGAGE. ARE YOU SURE?

Another study has found that many renters have actually saved up the amount of money necessary for a down payment on a home, but they don’t think they’ve saved enough or think they can’t qualify for a loan. Unfortunately, this simply isn’t true, even if you’ve had a short sale, foreclosure, or bankruptcy in the past.

According to Freddie Mac: “Depending on their credit history and other factors, many borrowers can expect to make a down payment of about 5-10%. And new 3% down financing options for qualified borrowers could mean a down payment as little as $6000 for a $200,000 home.”

HOW CAN I FIND OUT IF I CAN BUY?

If you are searching homes for rent in Knoxville, it’s time get off the rental roller coaster and stop the cycle of rising housing costs. Many have been caught in this trap. You might be ready and willing to buy a home, but don’t think you are able. Let’s change that! Contact me, Troy Stavros with Gables & Gates, REALTORS today and I will walk you through the EASY process of finding out if you are in a position to buy a home. Take this huge step towards increasing your net worth and more financial freedom. I hope to talk with you soon!