According to the 2018 Bank of America Homebuyer Insights Report, 74% of renters plan on buying in the next 5 years, with 38% planning to buy in the next 2 years!

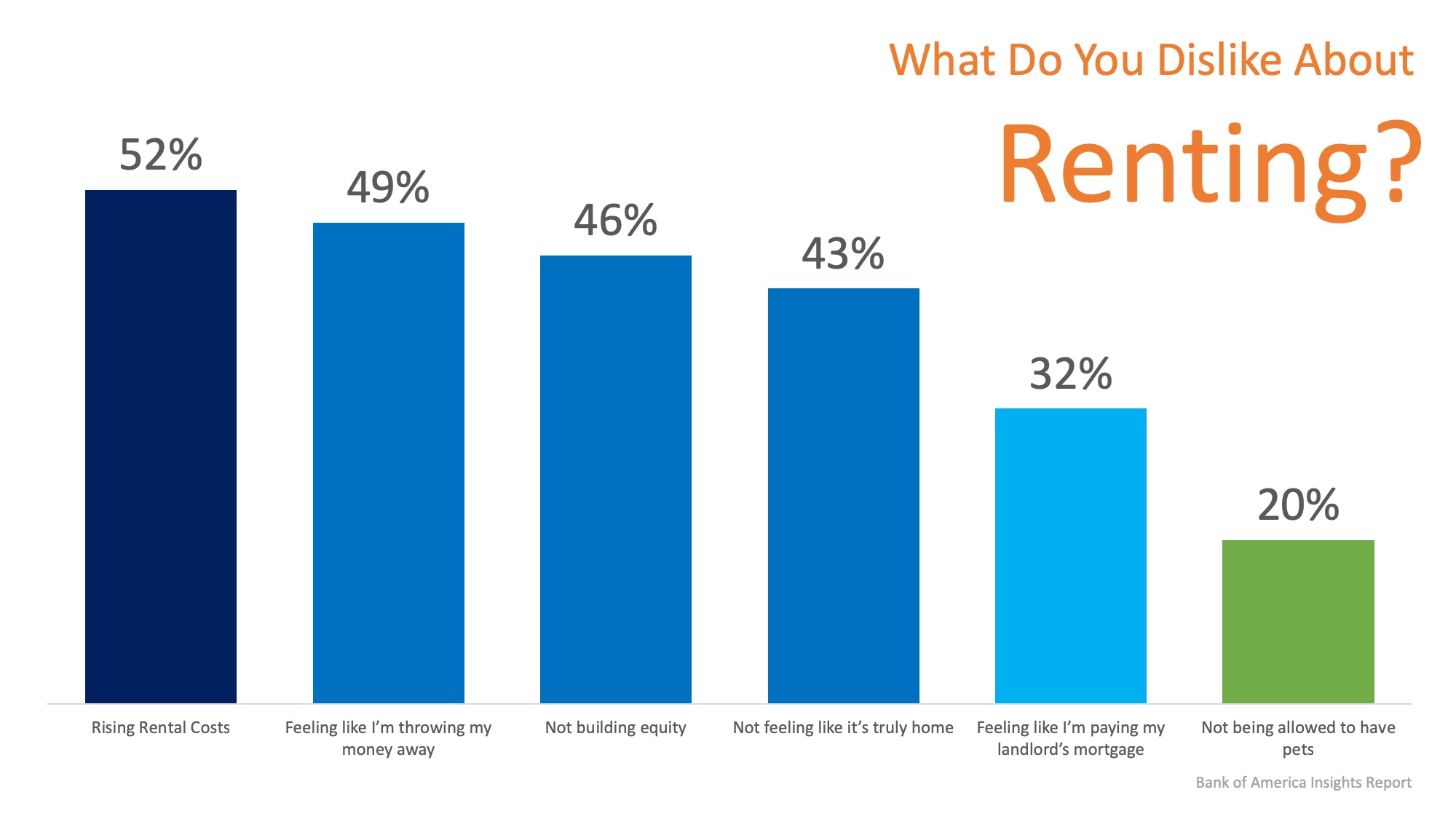

When those same renters were asked why they disliked renting, 52% said that rising rental costs were their top reason, and 42% of renters believe that their rent will rise every year. The full results of the survey can be seen below:

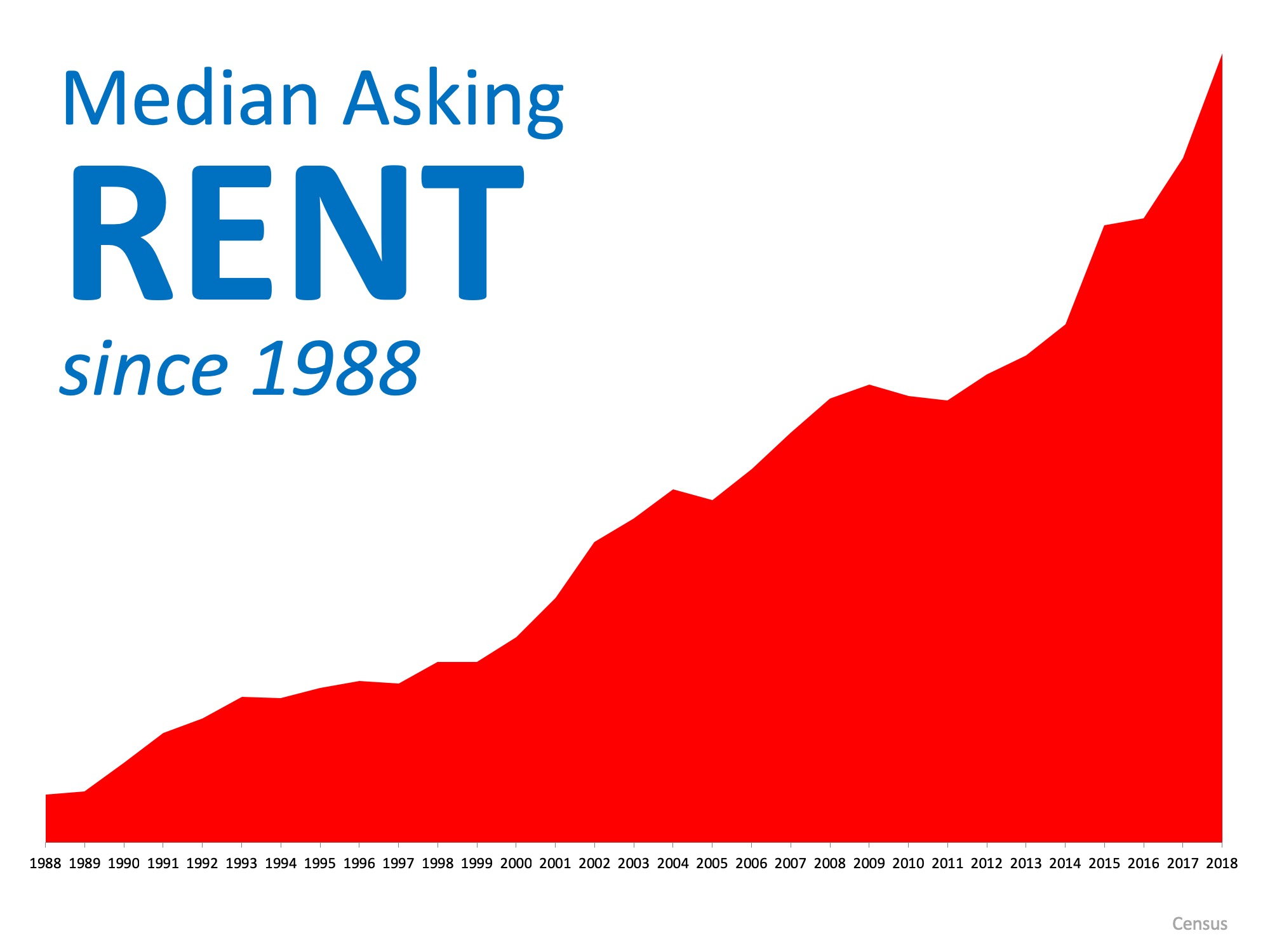

It’s no wonder that rising rental costs came in as the top answer! The median asking rent price has risen steadily over the last 30 years, as you can see below!

There is a long-standing rule that a household should not spend more than 28% of its income on housing expenses. With nearly half of renters (48%) surveyed already spending more than that, and with their rents likely to rise again… why are they renting?

When asked why they haven’t purchased a home yet, not having enough saved for a down payment (44%) came in as the top response. The report went on to reveal that nearly half of all respondents believe that “a 20% down payment is required to buy a home.”

If the majority of those who believe they haven’t saved a large enough down payment believe that they need 20% down to buy, that means a large number of renters may be able to buy now!

Bottom Line

If you are one of the many renters who is fed up with rising rents but may be confused about what is required to buy in today’s market, let’s get together to help you on your path to homeownership.