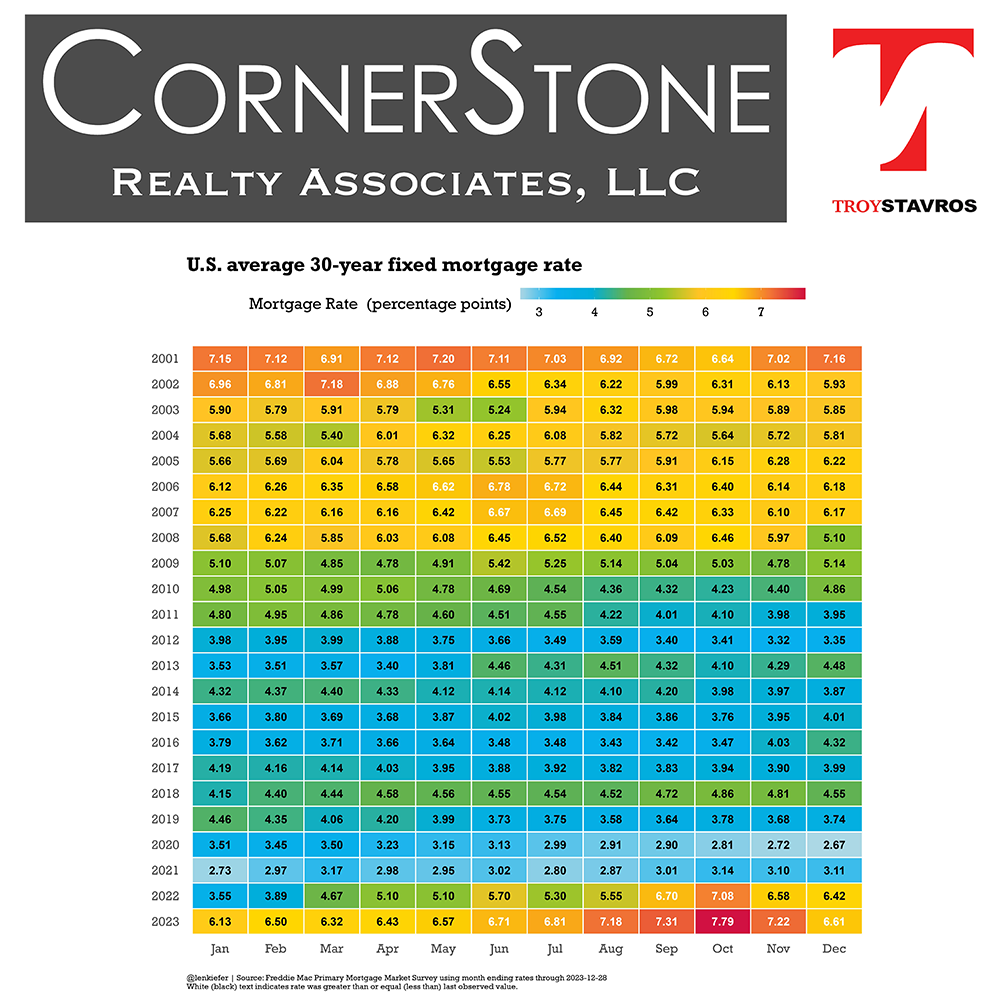

As a real estate professional, it’s important to understand the dynamics of mortgage rates and their impact on the housing market. This year, we’ve witnessed U.S. mortgage rates soar to their highest since 2001, culminating in a significant quarter-point increase from last year, even jumping over 8% in October. This uptick has directly contributed to one of the lowest home sales records in history, as higher borrowing costs have deterred many potential buyers.

However, there’s a silver lining. The rates have seen a decrease of over one percent from the highs of late October. This downward trend as well as recent news from the Fed indicates a potential easing of mortgage rates in 2024. As rates become more favorable, borrowing becomes less expensive, thus encouraging home buying. This expected shift can revitalize the housing market by increasing demand, stabilizing prices, increasing affordability and encouraging a resurgence in home sales. In essence, while 2023 has been challenging due to high mortgage rates, the anticipated fall in rates in 2024 is likely to bolster the housing market, providing a more favorable environment for buyers and sellers alike.