Let me repeat… You do not need a 20% down payment or perfect credit to buy a home!

A recent survey found that much of the American public is still misinformed about what is truly necessary to qualify for a home mortgage loan in today’s housing market. The two major misconceptions that the study pointed out were:

1. Down Payment

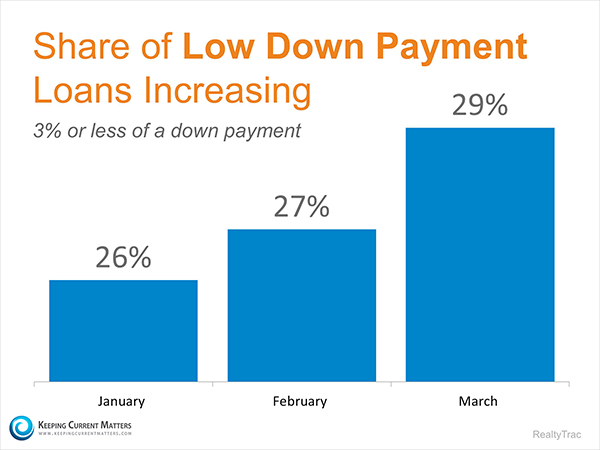

The survey showed that potential homebuyers overestimate the amount of money needed for a down payment to qualify for a home loan. The report noted that 36% of consumers think a 20% down payment is always required. In reality, there are a pretty large amount of loans written every day with a down payment of 3% or less. And while folks think that it’s harder now than before to get a loan, the truth is that the number of low down payment loans has actually increased through the first quarter of the year, as shown by the graph below:

2. Credit Scores

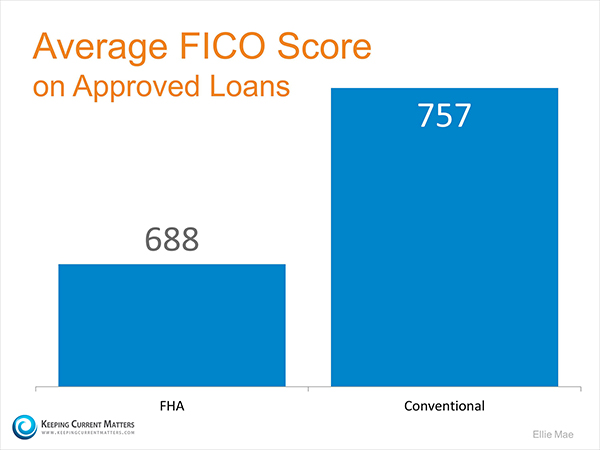

The survey also showed that 2/3 of the people that responded believe they need a very good credit score to buy a home. 45% of them are thinking a “good credit score” is over 780. But the truth is that the average FICO scores of approved conventional and FHA mortgages are much lower:

What does this mean for you?

If you are a someone thinking about buying a home, who is ‘ready’ and ‘willing’ to buy, but not sure if you are also ‘able’, sit down with someone who can help you understand your true options. I’d be happy to get you in touch with my preferred lender who has the heart of a teacher. She is always more that willing to take whatever time is necessary to educate you on the process and what is needed to get you into a home.

Have questions? Contact me (my contact info is below) and I’d be happy to help in any way that I can. I am here to serve you! You can also click below on “Mortgage & Refinance” to get the contact information of my preferred lender.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||