As we moved through 2023, mortgage rates saw several notable increases, often spiking by approximately half a percent within short periods spanning one to three weeks. After a significant upward adjustment in November, similar shifts were largely absent from the landscape—until recently.

An anomaly occurred in early February, characterized by a rapid decline in rates, which was promptly corrected. However, last week marked a return to brisk increases in mortgage rates, driven by a series of economic data releases.

The sequence began with a robust jobs report on April 5th, which initially pushed rates higher. The situation escalated with last Wednesday’s release of inflation data, which added to the concerns. Today’s Retail Sales report served as the final component of this trio of challenging economic news.

While Retail Sales figures typically indicate healthy economic activity and are generally viewed as a positive sign, they can have a contrary effect on mortgage rates. In the current economic climate, robust growth figures can be detrimental to mortgage rates. The market is currently on the lookout for solid evidence that the Federal Reserve’s strict monetary policies are effectively slowing economic growth. In simpler terms, the recent data does not suggest that Federal Reserve rate cuts are on the horizon. This mismatch has also had a direct and immediate negative impact on the broader bond market, particularly affecting those bonds that most directly influence mortgage rates.

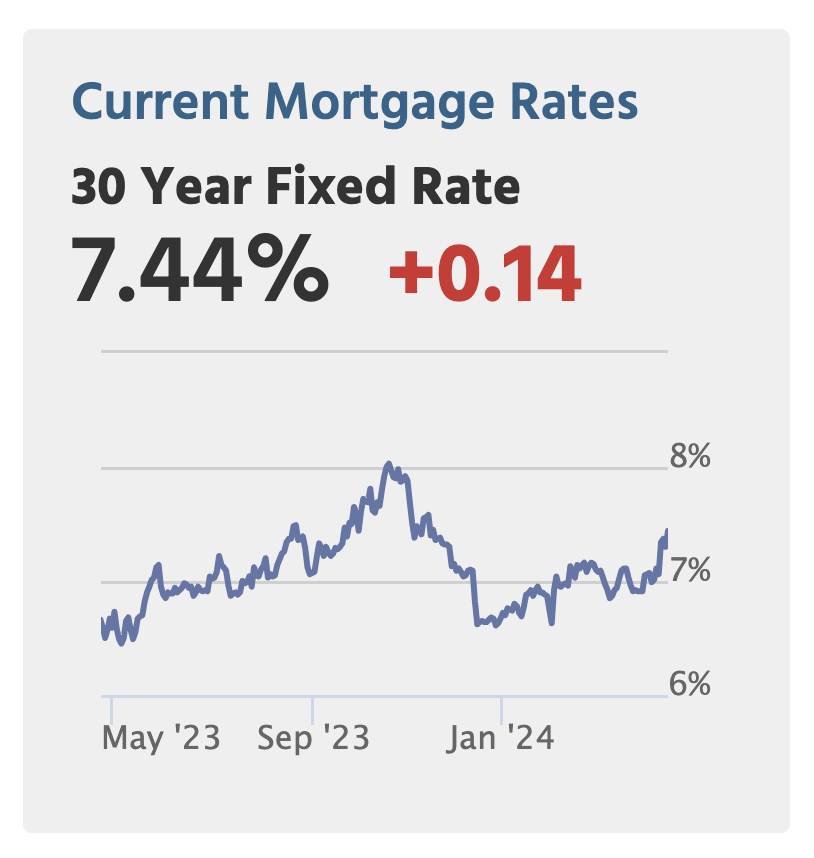

Consequently, mortgage rates have escalated once again, with the average lender now quoting rates in the mid-7% range for a top-tier, conventional 30-year fixed mortgage. This trend underscores the direct correlation between economic performance indicators and mortgage rate fluctuations, reminding borrowers and investors alike of the volatile nature of financial markets.